New analysis of the DWP’s latest workplace pension statistics from consultancy Broadstone highlights the need for smaller employers to boost member pension participation with over a million of their workers missing out on the billions of pounds of ‘free money’ that companies and the government contribute.

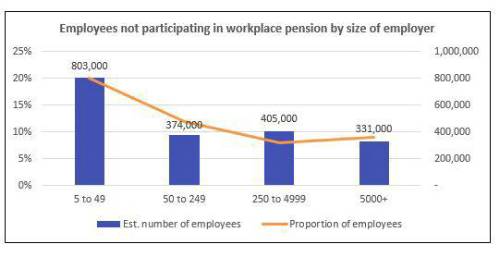

The data uncovers that one in five (20%) employees of smaller companies (5-49 staff) eligible for a workplace pension are not participating – equivalent to an estimated 803,000 workers.

It is the second successive year that a fifth of workers for employers of this size have not been contributing which suggests that after the initial success of auto-enrolment there is still a sizeable proportion of non-savers who need greater encouragement.

A further 12% of employees at businesses with 50-249 staff are not participating in their pension scheme marking a further 374,000 non-savers. It means nearly 1.2 million people working for SMEs may be falling through the pension accumulation gap running the risk of a lower income and quality of living in retirement.

Contribution rates at larger companies are far higher with under one in 10 employees at businesses with more than 250 people not participating in a workplace pension – equivalent to around 736,000 people.

Some employees may be contributing to a personal pension, which is not counted in this data, but it is typically a small proportion of people – the latest figures suggest around 5% of people have a personal pension – and they won’t always benefit from an employer top-up. These are predominantly older workers and may comprise people who are also participating in a workplace pension scheme.

Figures from the same government release also demonstrate the benefit to employees of participating in a workplace pension scheme – in total, employers in the private sector contributed £37.5 billion with employees gaining from a further £7 billion through tax relief.

Rachel Meadows, Head of Pensions and Savings at Broadstone, said: “Workplace pensions are a fantastic way for workers to save in a tax-efficient way and even get free money from their employers and the government.

“However, it is clear that employees at smaller organisations are falling through the cracks at a greater rate than among larger employers. This is perhaps because these businesses are less likely to have a plan in place to communicate the need to start accumulating pension savings for later-life.

“Boosting pension participation among colleagues is a key duty of employers in a post auto-enrolment environment as it is critical to protecting the long-term financial future of their colleagues. There is a benefit for smaller businesses too – it helps them attract and retain talent if workers know their employer is achieving best-practise standards in line with bigger organisations.

“Employers should be taking steps to increase communications and provide sources of guidance on the benefits of pension saving to make clear the responsibilities individual pension savers bear as well as the vast financial contribution that employers and the government will also make. With pensions being one of the biggest employee benefit costs for most employers, allocating a small extra spend on boosting staff knowledge can reap a big reward.

“This is the key to improving understanding, and therefore engagement and participation, among employees and ultimately aligning participation rates with larger employers.”

|