-

Property and Private Equity top performing sectors in first half of 2011

-

El Oro is top performing company up 50% in first half of 2011

-

UK Smaller Companies was the top performing sector over a year up 42%

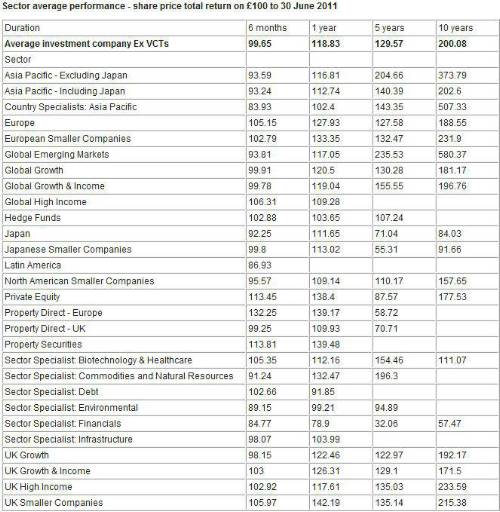

The first half of 2011 has proved to be something of a hippo market for investors, with a sideways-moving market interspersed with short-term bouts of volatility emanating from Japan, the Middle East and the Eurozone. The average investment company was neither up nor down, with a £100 investment over six months to 30 June 2011 remaining at £100. The average discount widened slightly, from 8% at the year end, to 9% at 30 June 2011.

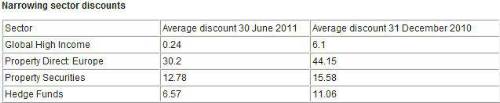

With markets so uncertain, it is interesting to see that the Property Direct: Europe sector has seen discounts narrow most from 44% six months ago to 30% at the end of June 2011. Other sectors which saw their discounts narrow include Property Securities, Hedge Funds and Global High Income (see table on page 3).

Specialist sectors dominate

There were some winners too in the first half of the year, particularly in the specialist sectors. Property Direct: Europe was the top performer over six months to 30 June 2011, up 32%. But with average net gearing in this sector standing at 162% against an industry average of 7%, it is not for the faint hearted. Property Securities was the second top performing sector over six months, up 14%, with an average gearing level of a more modest 4%, followed by Private Equity, which was up 13%. Nevertheless, discounts in the Private Equity sector have been largely unchanged on average over the last six months, and were an average of 25% at 30 June 2011.

Illustrating the dominance of specialist funds over the last six months, the top performing AIC Members were El Oro (Sector Specialist: Commodities and Natural Resources), up 50%, Sirius Real Estate (AIM) (Property Direct: Europe), up 45%, Greenwich Loan Income (AIM) (Sector Specialist: Debt), up 42%, Real Estate Credit Investments (Sector Specialist: Debt), up 41% and Tamar European Industrial (Property Direct: Europe), up 36%.

Net Gearing

Across the investment company industry as a whole net gearing on average has been unchanged, and was 7% at 30 June. The Private Equity sector was an exception, with gearing on average down from 15% six months ago to 7% at 30 June 2011. The European Smaller Companies sector was another notable exception, with gearing down from 10% at the end of December to 4% at the end of June 2011. This perhaps reflects instability in the Eurozone and both these sectors have also benefitted from strong performance which will have increased their assets and therefore impacted on gearing levels.

A good year for UK Smaller Companies

Whilst the investment company sector has tended to move sideways over the last six months, over the last year things are looking up, with the average investment company up 19%. UK Smaller Companies was the top performing sector, up 42%, with Strategic Equity Capital, also a UK Smaller Companies fund, the top performing AIC Member, up 76% (over six months, the fund is up 31%). Standard Life UK Smaller Companies was not far behind, up 70%, making it the second best performing AIC member (over six months it is up 8%).

In another sign that specialist sectors are beginning to dominate the short-term performance tables, Property Securities was the second best performing sector over the year, up 39%, alongside Property Direct: Europe, also up 39%. This was followed by Private Equity, up 38%. European Smaller Companies was the fifth best performing sector over the year, up 33%.

Asia Pacific, Emerging Markets & Commodities still outperforming over longer term

Whilst it's been a more challenging year for Asia Pacific sectors, over the medium-term, the Asia Pacific, Global Emerging Markets and Commodities and Natural Resources growth story remains intact. The top performing sector over five years to 30 June is Global Emerging Markets, up 136%, followed by Asia Pacific Excluding Japan, up 105% and Sector Specialist: Commodities and Natural Resources, up 96%. Interestingly, the fourth best performing sector over the last five years is from the more generalist Global Growth & Income sector, up 56%, followed by Sector Specialist: Biotechnology & Healthcare, up 54%.

Over the last ten years, the Asia Pacific and Global Emerging Markets again have a tendency to perform strongly. The top performing sectors are: Global Emerging Markets (up 480%), Country Specialists: Asia Pacific (up 407%), Asia Pacific - Excluding Japan (up 274%), UK High Income (up 134%) and European Smaller Companies (up 132%).

Annabel Brodie-Smith, Communications Director, Association of Investment Companies (AIC) said: "Markets over the last six months have faced uncertainty fuelled by events in Japan and instability in the Eurozone. The famously coined ‘hippo market' seems particularly relevant for these times, although some of the specialist sectors have proved resilient over the last six months and year.

"However, the performance figures illustrate the importance of having a balanced portfolio. It's almost impossible to time the market, least of all pick the top performers of the future. So a balanced portfolio, taking into account geographical and sector allocation, discounts, gearing and charges, is a good place to start. Cautious investors may also like to consider regular investing, which can help smooth out some of the highs and lows in the price of shares, reducing investors' risk profile. And whilst it's always interesting to look at short-term trends, above all, investors need to remember that investing is for the long term."

|