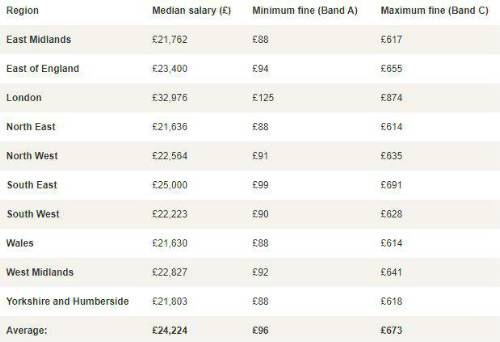

Authorities introduced a new banding system in 2017 for people who were seen to be ‘serious speeding offenders’.2 Fines are now split into bands from A-C and the penalty depends on how fast the driver is travelling above the speed limit. The new three band system means fines are now based on weekly income, with the most serious offences potentially costing drivers thousands of pounds. Across all fine bandings, the average driver can expect to pay a minimum of £96 (25 per cent of weekly income) if found guilty of committing a Band A offence with mitigating circumstances and a maximum of £673 for a Band C offence (175 per cent of weekly income).

Last year, speeding cost Britain’s drivers a massive £162.5 million in fines, with the average fine costing £222. The value of speeding tickets has increased by 24 per cent since 2014 (£179). This increase, and the introduction of the new banding system does not appear to have been a deterrent for speedy drivers, with nearly 30,000 more drivers proceeded against last year than in 2014 – the equivalent of 16 more every day.

Between 2014 and 2018, the number of speeding offenders who were found guilty rose by just 14 per cent (20,539) resulting in the conviction rate falling below 90 per cent for the first time in a decade. For those drivers who were convicted last year, the vast majority (99 per cent) received a fine and had their driving licence endorsed (92 per cent) while only 2.5 per cent were disqualified from driving.

Regional analysis

On a regional level, drivers in London are now at greatest risk of being hit by the new fines, with the median salary in the capital (£32,976)3 being 36 per cent higher than the average for England and Wales. This means the average driver in London could be required to pay a fine as high as £874 for a Band C offence – just below the fine cap of £1,000.

Nevertheless, London’s drivers do not appear to be slowing down, with the number of people caught speeding by the Metropolitan Police Service more than doubling since 2014, from 10,187 to 20,916- an increase of over 105 per cent.

Table one: Regional fine estimates

Source: Churchill Car Insurance 2019

Alex Borgnis, Head of Car Insurance at Churchill,said: “Speeding is one of the biggest causes of accidents on Britain’s roads. Not only is going above the speed limit dangerous for everyone on the road, but motorists also risk landing themselves a substantial fine and points on their licence. Under the new speeding laws, drivers could receive a speeding fine of up to £1,000, rising to £2,500 if caught on a motorway.

“We all lead busy lives often leading us to rush around, but speed limits are put in place for a reason. Motorists should take their responsibility to drive with care seriously, not only for themselves but for all road users.”

|