Simon Cohen, Head of Investment Consulting at Spence, commented: “Volatile markets present both opportunities and threats for pension schemes. In order for them to present an opportunity, schemes must monitor their funding level more actively in order to be able to take prompt action to lock-in investment gains and reduce future volatility. Schemes should assess their risks and take control of a strategy to achieve the ultimate goal of paying all benefits to members in full without bankrupting the employer in the process.

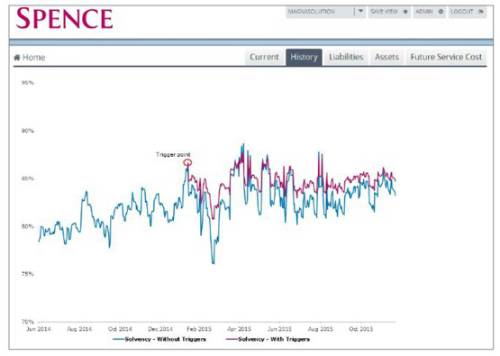

“There is fantastic technology available in the market which allows schemes to implement trigger points** and monitor their funding level in real time allowing them to switch investments to a more optimal allocation, far more rapidly than ever before - even for small schemes. These trigger points, alongside demanding more of managers, being careful about diversification and perhaps looking at other options like illiquid assets, means scheme trustees can optimise their investments.”

Hugh Nolan, a Director at Spence and Partners, added: “There is always something that schemes can do to address even the most challenging situation. Many schemes (including British Steel) are hoping for a rise in gilt yields to reduce the capital value of benefits promised, but interest rates remain stubbornly low. This gamble may well be appropriate for many schemes, as there is surely more scope for an increase in yields than for a further drop of any real size. Trustees need to consider how much risk they can afford to take based on their own circumstances, including how strong the sponsoring employer is and what, if any, assets are available to the scheme if things do get even worse.

“Either way, the message is clear. Schemes can take effective action to control risks and minimise costs, as long as trustees and employers are brave enough to avoid the paralysis inspired by the complex problems they’re facing.”

* The BHS Scheme disclosed a surplus in 2008 but had a deficit of £226m by 2015. Similarly the £15bn British Steel Pension Scheme saw its deficit treble over a single year to 31 March 2015, despite holding 70% of the its assets in defensive stocks.

** The graph below is a case study of a scheme who set a trigger to switch investments when market conditions reached a pre-determined level. The scheme started off at 78% funded and moved into less volatile assets when the funding level rose past 85%, within just 12 months. The funding level dropped to slightly over 80% just two months later but the trigger approach avoided a fall down to 75%. The scheme remains better funded and has a less risky investment strategy due to the success of this active market monitoring.

|