Beazley has published the second edition of its report, Spotlight on digital health and wellness 2022, which examines changing attitudes to risk and insurance among digital health and wellness leaders in North America, Asia, the UK and Europe.

Key findings

Opportunities and challenges abound for this rapidly growing industry:

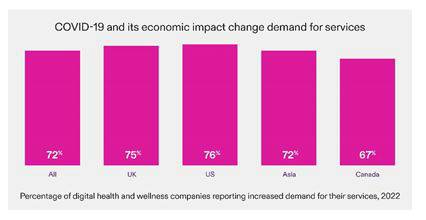

• 72% of the firms surveyed report growth in demand and 99% are planning expansion

• Only 62% of leaders believe they operate in a moderate to high-risk environment compared to 89% last year

• Cyber and regulatory risk dominate, cited by 27% and 47% of leaders globally

• 76% do not have a single insurance policy tailored to the risks they face.

Growth is rapid and accelerating

Globally, just over 72% of health and wellness businesses we surveyed report increased demand for tech-related services, which is a substantial increase from 2020, when only 58% saw increased demand.

Jennifer Schoenthal, Product Leader – Global Virtual Care, Beazley commented: “COVID-19 has transformed the global appetite for digital health and wellness services. This, along with associated shifts in public health policy in almost every country, have made it easier for people to access health services online. Against this backdrop, every aspect of digital health and wellness services, including telehealth, telemedicine, mHealth, HealthTech software platforms and life sciences technology, have grown fuelled by a solid track record of innovation, a wave of fresh capital, international expansion plans and patient/customer demand.

“We as an industry need to continue to stay connected to industry leaders’ concerns and work closely with our clients as their businesses grow and digital health models move forward. We also can look for areas to drive better collaboration to deliver more insightful and responsive, tailored insurance coverage to meet fast-changing customer needs.”

Pandemic has increased claims

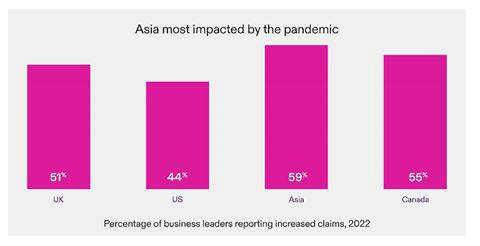

Over half (52%) of respondents globally reported that the pandemic had increased claims. This trend was particularly strong in Asia.

Beazley’s own claims experience is in line with these findings. The US team has seen a significant increase in the number of telemedicine claims since 2017, although in line with the increase in policies underwritten as the sector has boomed.

Evan Smith, Global Head of Miscellaneous Medical and Life Sciences, Beazley said: “The claims experience of different sectors seems to reflect both the relative maturity of these industries but also the radically different nature of their operations during the pandemic.”

Few companies buy bespoke cover

One of the standout findings is that 76% of the companies surveyed do not buy a single tailored policy, increasing the risk of coverage gaps and shortfalls.

Keri Marmorek, Claims Focus Group Leader, Miscellaneous Medical & Life Sciences, Beazley commented: “The new and unique combination of risks within digital health and wellness services create a complex web of interconnected exposures that can be hard to get to grips with for business leaders, and also for brokers and insurers that are often new to the digital health landscape. Failure to join the dots between these key risks means that under-insurance and gaps in coverage pose an issue for insureds.”

Bodily injury risks fail to register

A further finding from the research is that many companies lack the coverage they need for everyday risks that could lead to significant claims, and in particular for bodily injury claims arising from digital healthcare. For example, globally:

• 62% don’t have coverage for technology errors or omissions leading to bodily injury

• 69% are not covered for medical malpractice due to incorrect data leading to bodily injury

• Only 37% have coverage for bodily injury due to remote care.

|