The Broadstone Sirius Index – a monitor of how various pension scheme strategies are performing on their journeys to self-sufficiency – posts its latest update.

The Broadstone Sirius Index delivers its Q1 2024 update on pension scheme’s journeys towards self-sufficiency.

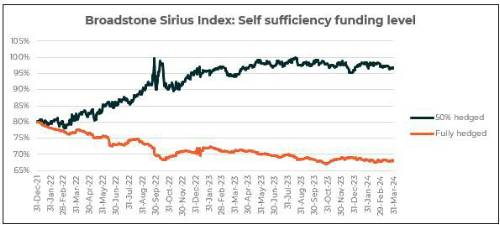

It finds that the fully hedged scheme lost slight ground through the opening quarter of the year, with its funding position dropping from 68.9% to 68.2%.

In contrast, the half hedged scheme’s funding level registered a marginal increase, rising six percentage points from 96.1% to 96.7% between December 31 2023 and March 31 2024.

Chris Rice, Head of Trustee Services at Broadstone, commented: “The stable and improved funding environment for pension schemes is driving record demand within the insurance market. Thankfully, insurers are scaling up to meet this demand and an increasing array of choices is on the horizon.

“The opening quarter of 2024 continued many of the same trends we saw in the previous year with stability in the market sustaining vastly-improved pension scheme funding levels. The main driver of volatility remains the fight to rein back inflation as well as market expectations surrounding the Bank of England’s rate decisions.

“The insurance market remains hot with bulk annuity transaction volumes expected to set yet another record after nearly reaching £50bn in 2023 by surpassing £60bn in 2024.

“But for schemes feeling left behind in the de-risking market, perhaps due to the complexity of benefits, readiness to buy-out, premium size or funding levels, there are increasingly more options to consider.

“As well as existing insurers scaling up, we have seen new entrants in the de-risking market with rumours of more to come, the first two commercial superfund deals have been completed while the government is consulting on the establishment of a new PPF-run public sector consolidator.

“Trustees can also now explore the potential for running on as a viable alternative to buy-out by reaching low dependence on the employer’s support, especially as the regulator explores the ability of freeing up surpluses.”

|