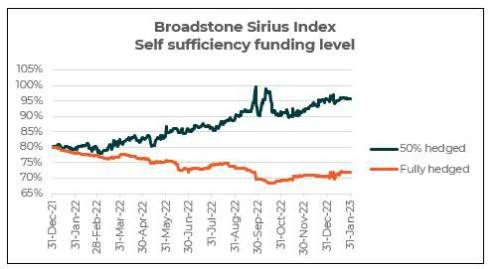

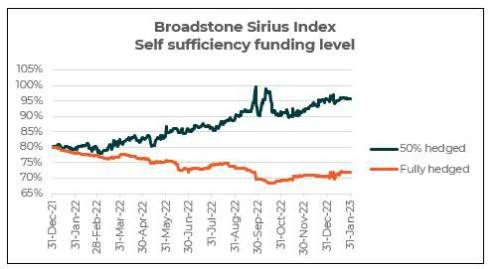

The Broadstone Sirius Index found that continued market stability through January saw both its hedged and 50% hedged schemes make small improvements in funding levels and reduce deficits.

It comes following significant volatility at the end of last year. Fully hedged schemes saw a 9 percentage point drop through the year so January marks a positive recovery, while half-hedged schemes performed well in 2022.

Breaking scheme funding down into assets and liabilities it is clear to see that liability reductions have far outpaced falls in asset values.

For example, the 50% hedged scheme which had £40m of assets as at January 2022 has seen that value drop to £30m as at February 2023. However, the £50m of liabilities have outpaced this decline reducing to £31m over the same period resulting in the dramatically smaller deficits that we’ve previously seen.

Nigel Jones, Head of Consulting & Actuarial at independent consultancy Broadstone, said: “The start of the year has been a quiet one with little volatility in funding positions. This is good news for schemes still taking stock from last year.

“The outlook for the UK economy remains unclear. Last week’s interest rate rise shows that the Bank of England is still concerned about the impact and pace of inflation as well as the UK’s recovery from the shocks of 2022.

“This rate rise was expected and long-dated gilt yields appear to be falling ever so slightly. We will continue to monitor this and report with future versions of the Broadstone Sirius Index.

“The release of the Pensions Regulator’s Funding Code reiterated the importance of our low dependency measure of funding as the long-term target for Trustees as they manage down the risk in their defined benefit scheme. We are working on further enhancements to the Index to ensure it matches TPR’s expectations and helps our clients set the appropriate strategies for their funding journey.”

|