Recommendations include early access to the state pension for those with a terminal illness, the introduction of a means-tested bridging benefit, and a co-ordinated Sustainable Work Fund

Physical health, mental health and age discrimination are the main barriers to remaining in work until retirement age, as polling shows 51% of UK adults expect to stop working before their state pension age**

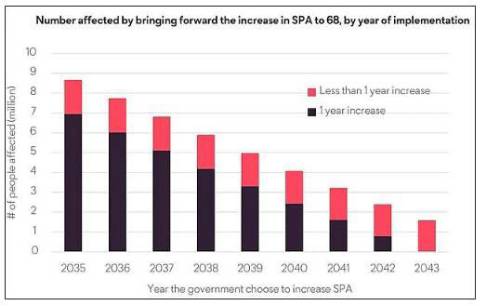

Nearly 7 million people will be impacted if the state pension increase to age 68 is brought forward to 2037, as recommended by the Cridland review

As the state pension marks its 75th anniversary in July, Phoenix Insights, Phoenix Group’s longevity think tank, says reforms are needed alongside future changes to the state pension age, to help people stay in work and to support those who can’t. The think tank warns that without reforms, delaying access to the state pension income alongside widespread under-saving creates a perfect storm for worsening poverty among people in the years leading up to their state pension age and into retirement.

Phoenix Insights’ latest report An intergenerational contract - policy recommendations for the future of the state pension draws on a ground-breaking year-long study working with the public to understand their views and expectations of the state pension system.

With increases to the state pension age, people will need to work for longer or draw on other resources – such as a private pension savings, or working age benefits – in order to bridge the gap between stopping working and receiving income from the state pension.

However, polling shows currently half (51%) of people expect to drop out of work before reaching their state pension age. Physical health, mental health, and age discrimination are the main barriers preventing people remaining in work until their state pension age. Meanwhile, Phoenix Insights’ modelling shows that over a third (36%) of people are already unlikely to be saving enough to meet their financial goals for retirement. Dipping into these saving early will further deplete retirement income prospects.

There is most concern for those unable to remain in work and without sufficient resources to draw upon. This group faces a benefits system that pays significantly less to those of working-age than those above state pension age.

The difference in these benefits was highlighted as a significant driver of the increase in poverty among those aged 65 following the increase in the state pension age from 65 to 66, and more people could fall into poverty as the state pension age increases further.

To support people in the years leading up to retirement and those who do not currently benefit from the state pension system, Phoenix Insights recommends:

Early access to state pension for those with a terminal illness: Allow early access to a weekly payment equivalent to the state pension to support adults of any age with a diagnosed terminal illness and a life expectancy of less than six months. Paid at the equivalent rate to the state pension and pro-rated depending on the individual’s National Insurance contributions as advocated by organisations such as Marie Curie.

Means-tested bridging benefit: A top up to Universal Credit, equivalent to pension credit, accessible one year before their state pension age, for those on low incomes with a work limiting health condition, or caring responsibilities.

A co-ordinated Sustainable Work Fund: Used to engage and support employers and workers. This will create opportunities for better, healthier and more sustainable working lives for all ages, through a major boost to lifelong learning, interventions such as mid-life MOTs, and workplace health and careers advice.

These changes, and other proposals in the report, could be funded by reinvesting the equivalent of 20% of the amount that the Treasury would save whenever the state pension age increases.

Patrick Thomson, head of research and policy, at Phoenix Insights, comments: “The state pension is the biggest single part of the social security system and has been the foundation for many people’s retirement income over the last 75 years. However, looking ahead, it is facing serious questions of intergenerational fairness and affordability as large numbers reach retirement in the coming decades.

“Increasing the state pension age will mitigate some of the costs, but delaying access to state pension payments alongside the under-saving crisis creates a perfect storm for worsening poverty for those unable to remain in work until their late 60s.

“Policy interventions are needed in the years approaching state pension age so that more people aren’t dragged into financial hardship. We also need to radically change the way that we think about work, making it more sustainable and fulfilling, with better opportunities to upskill, change careers and save for a good retirement.

“The state pension is an important intergenerational contract, but not everyone knows what they’ve been signed up to. Our research shows that knowledge of the state pension is poor, and people are worried that they may not receive the same benefits as today when they reach their retirement age. Any changes to the system need to be effective, fair and trusted.”

State pension age acceleration to affect 7 million

While the decision to increase the state pension age from age 67 to 68 to mitigate rising costs has been delayed until after the next general election, bringing this forward to 2037, as recommended by the Cridland review, means nearly 7 million people will retire later compared to what is currently legislated (Figure 1). Of this group 44% of defined contribution savers are not on track for their planned retirement lifestyle.

If the latest proposal from the Neville-Rolfe review to cap spending on state pensions to 6% of GDP was enacted, a 30 year old today could face a state pension age of 74, raising serious questions of intergenerational fairness.

Figure 1: Phoenix Insights (2023), analysis of ONS population estimates (mid-2021)

|