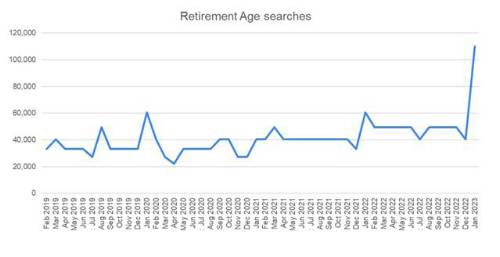

Amid recent speculation the state pension age may be increased sooner than currently planned, internet searches for the phrase ‘retirement age UK’ surged in January this year, according to analysis from Standard Life, part of Phoenix Group.

Standard Life’s Search Radar found 110,000 searches were recorded in the first month of the year, up 82% compared to January 2022 when only 60,500 searches were conducted. Overall, ‘retirement age UK’ searches were up 20% in 2022, compared to 2021.

This was likely driven by more people researching whether they will be affected by the state pension age review which is currently underway, with reports suggesting plans to bring forward the timeframe for planned age increases and potentially raising the state pension age to 68 as soon as 2035. This is in addition to previously announced changes to the normal minimum pension age which is increasing from 55 to 57 in 2028, which is likely to have further compounded the number of online searches demanding information about ‘retirement age’.

Meanwhile, online searches related to taking early retirement decreased with the number of searches for the term ‘retire by 55’ down by 23% year on year, while ‘retire by 40’ was down by 46%.

Surge in retirement age searches in January 2023

Searches for debt help also on the up

Consistently high inflation, rising interest rates and the continued cost-of-living squeeze is also driving an uptick in searches associated with problem debt in January 2023. Standard Life’s analysis reveals searches for information and support around debt have significantly spiked year on year compared to January 2022*:

• Can’t pay credit card debt (+200%)

• Iva debt help (+171%)

• Debt consolidation help (+129%)

• Help paying debt (+91%)

*figures show uplift from January 2022 to January 2023

Dean Butler, Managing Director for Customer at Standard Life, comments: “The government is in the process of reviewing the state pension age and reports that plans may be afoot to raise the age to 68 much sooner than expected appear to have caught many peoples’ attention as they went online for information in their thousands. The state pension is the foundation of most peoples’ retirement income so any change will have far reaching consequences. In particular it creates challenges for people who wish to retire early and need to fund an extended period before the state pension kicks in and also those who may not be in good enough health to work up to state pension age.

“Following more than a year of the cost of living crisis, we have also seen searches focused on problem debt spiking year-on-year between January 2023 and January 2022. This marked surge in people looking for help online highlights how significant it is for the Bank of England to get inflation under control, and the need for ongoing support for those impacted most heavily by the crisis.”

|