Over Q2 as a whole, the Aon UK DC Tracker rose which suggests the expected future living standard in retirement provided by defined contribution (DC) savings was higher than at the end of the previous quarter.

All members benefited from the April 2024 increase in the state pension, which increased from £10,600 to £11,500 per year. The oldest saver saw the largest proportionate increase from this change as the state pension makes up a larger proportion of their expected retirement income. Positive returns over the quarter together with changes to future expected investment returns further increased the expected retirement income for all members.

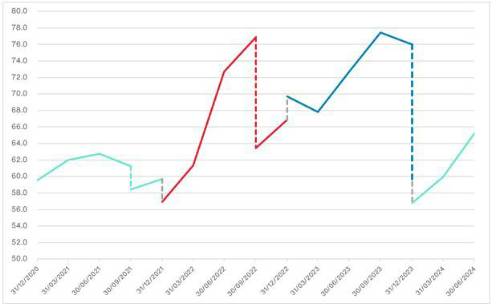

Aon UK DC Pension Tracker

Source: Aon UK DC Pension Tracker (1 April to 30 June 2024)

Over the quarter (April to June 2024) the Tracker rose from 60.0 to 65.2. This was driven by April’s

8.5 percent increase in the state pension, together with increases in post-retirement expected investment returns.

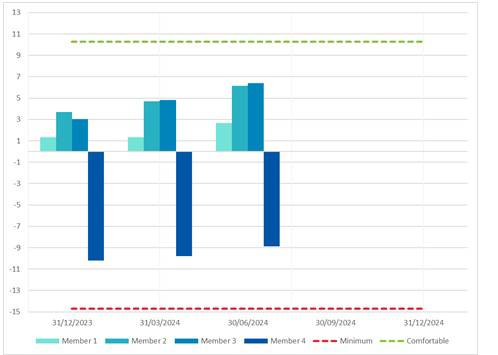

Savers’ Positions (measured compared to the ‘comfortable’ living standard)

Source: Aon UK DC Pension Tracker (1 April to 30 June 2024)

Latest increase to the state pension has boosted outcomes for members

In April 2024, the new full state pension was increased by 8.5 percent to over £11,500 a year, in line with the triple lock.

Matthew Arends, partner and head of UK retirement policy at Aon, said: “This £900 boost to all our sample members’ retirement incomes propelled much of the increase in the Tracker over the quarter. Following this increase, the state pension now accounts for around 80 percent of the single person’s minimum retirement living standard before any other form of pension saving is taken into account. This demonstrates the importance of the state pension and how fast it increases, particularly to those on lower incomes.”

Movement over the first quarter of the year

As discussed above, the increase in the Aon UK DC Pension Tracker over Q2 of 2024 was primarily driven by the increase in the state pension. However, an increase in expected return assumptions along with positive performance over the quarter also helped to boost expected retirement outcomes for all members.

Matthew Arends said: “The retirement expectations of our sample members are influenced both by recent experience, such as increases to the state pension and actual investment performance, along with forward-looking expectations such as future investment returns. In Q2 most of these elements improved, leading to a sharp increase in the DC Tracker. No doubt this would bring some relief to our sample members, although this improvement in expectations does not yet cancel out the effects of cost of living rises from high inflation during the past two years.”

• The youngest saver’s expected income increased by around £1,500 p.a. (4.6 per cent), with around £900 of this increase the result of the state pension increase. The remaining increase in expected income was partly due both to an increase in the expected future investment return assumptions and to positive benchmark investment returns over the quarter.

• The 40-year-old saver saw an increase of around £1,700 p.a. (or 4.6 per cent) in their expected retirement income. Again, positive actual investment returns drove this along with increases to the investment return assumptions and the state pension.

• Our 50-year-old saver saw the largest £ amount increase, with an increase in expected retirement income over the quarter of around £1,800 p.a. (4.9 percent) when compared with the start of the quarter. Due to this saver’s larger existing funds, they benefited the most from the positive investment returns over the quarter. They also benefited from increases to the expected post-retirement investment return and the increase in the state pension.

• The oldest saver saw an increase of £1,090 p.a. (around 5.0 percent) - almost entirely driven by the increase in state pension that occurred during the quarter. Being the closest to retirement, they were also positively impacted by changes in future post-retirement return expectations.

• Overall, the oldest saver is expected to be the worst off in retirement, albeit with a retirement income of around 145 percent of the ‘minimum’ Retirement Living Standard. This excludes any defined benefit pension benefits they may have but which are not included in this projection. As the state pension makes up a higher proportion of this saver’s expected retirement income, they benefited the most from the significant increase applied in April.

• Following the most recent increases to the Retirement Living Standards, all savers are further from reaching a ‘comfortable’ standard in retirement. The 40-year-old and 50-year-old savers are now expected achieve an income in retirement broadly mid-way between the moderate and comfortable standards. The youngest saver is currently expected to achieve an income in retirement only slightly above the moderate standard.

|