Plans announced by the BBC to limit free TV licences for over 75s to those claiming pension credit were met with huge objections, and not just amongst the over 75s. To shed light on the value of a range of age related benefits Aegon has analysed various benefits to illustrate the present value of funding them for the rest of the beneficiary’s life or over a realistic fixed period reflecting likely usage.

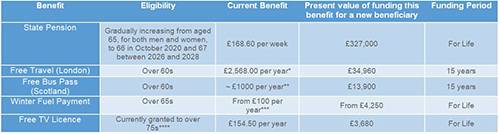

Table 1: Aegon Analysis of Age Related Benefits with their ‘present’ value

*Adult yearly London travelcard, zones 1-6

**Bus travel is free across Scotland so figure based on average city bus pass of around £700 plus allowance for some longer trips.

***Can be up to £300 depending on age and marital status.

****The BBC are set to restrict free licences to over-75s who claim the pension credit benefit from June 2020.

Aegon Analysis shows the relative monetary value of age related benefits

The analysis shows that the present value of the state pension at its full level of £168.80 per week is £327,000, significantly higher than any other age related benefit. So for someone to buy the full state pension for the rest of their life through an annuity, it would cost £327,000.

For those meeting the age eligibility criteria, free travel on some modes of public transport would also come at a high cost. In London, the present value of buying an annual travel card (zones 1-6), similar to the benefit of a 60+ Oystercard, for the next 15 years would come to just under £35,000. In comparison, buying bus passes for a Scottish city and other periodic trips across Scotland which are also free would cost around £14,000.

The winter fuel allowance for over 65s adds up to at least £4,250 over a lifetime for someone receiving the basic £100 a year, and considerably more for those entitled to a higher annual sum.

The free TV licence from age 75 comes in at the lowest value benefit, although at its current level of £154.50 per year, is still worth around £3,680 over a lifetime.

Steven Cameron, Pensions Director at Aegon, comments: “It’s great news that on average, in the UK, we’re living longer. But we need to face up to the costs of those longer lives if we are to enjoy our later years to the full. Most people accept that the state through taxes should make sure our older generations have a basic entitlement to a core state pension. Recent increases in the starting age have aimed to make this affordable as we live longer and to avoid past mistakes, the Government needs to make sure any changes are communicated well in advance.

“Other benefits such as free travel, the winter fuel allowance and free TV licences can make a big difference to the standard of living of the millions on pensioners on fixed incomes and any suggestion of removing these or making them means tested are likely to create outcries, as we’ve seen with the BBC’s proposal.

“For many people, the benefits they receive from the state will make up a core part of their retirement income and lifestyle. However, those some way off retirement should think seriously about whether they are confident the state pension and other current entitlements will provide them with the lifestyle they aspire to in retirement. For most, the best and safest course of action will be to make additional personal provision, for example by saving through a workplace or personal pension. It can pay to get financial advice. “

|