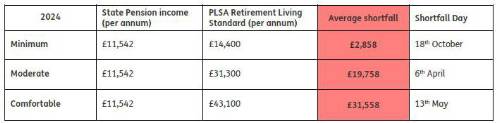

With over two months of the year still to go, today marks State Pension Shortfall Day – the point in 2024 when a single pensioner on the ‘minimum’ of the PLSA Retirement Living Standards would have exhausted the full new State Pension (£11,542 in 2024-25) and be reliant on private pension income or other savings to bridge the gap. A single pensioner requires annual income of £14,400 a year to achieve the ‘minimum’ of the PLSA’s Retirement Living Standards1. Spreading both the full new State Pension and this ‘minimum’ expenditure evenly across a twelve month period leaves a shortfall of £2,858 a year – or a period of around two and a half months – with the State Pension running out on 18th October 2024.

Pensioners aspiring to the ‘moderate’ or ‘comfortable’ Retirement Living Standards will need to save significantly more to generate the income to fund expenditure of £19,758 and £31,558 a year, respectively. Those who only have retirement income from the full new State Pension would face running out of money much earlier in the year if their spending was aligned with these two higher Retirement Living Standards. The PLSA defines the ‘minimum’ Retirement Living Standard as covering all of a pensioners’ needs, with some left over for fun and social occasions, including a one week holiday in the UK, eating out about once a month and some affordable leisure activities about twice a week.

Stephen Lowe, group communications director at retirement specialist Just Group, commented: “At a time when government support for retirees’ finances is under scrutiny, State Pension Shortfall Day marks the day in the year when a pensioner living to a ‘minimum’ standard would theoretically run out of money if their only source of retirement income was the State Pension. “Despite two successive, significant increases, the full new State Pension still falls nearly £3,000 a year short of meeting the ‘minimum’ of the PLSA’s Retirement Living Standards and is nearly £20,000 lower than the income required to support a ‘moderate’ standard of living. The State Pension remains a fundamental building block of retirees’ annual retirement income but for many people this level of income will not provide the resources to sustain the kind of retirement they need.

“People have an aversion to long-term planning and find it easier to focus on near term events, but we need to make it simpler for them to see the consequences of how their saving habits can support them in later life. Pension adequacy is a topic growing in importance.”

|