State Pension on average makes up nearly £6 in every £10 of income of income received by those aged 65 and over, and up to £9 in £10 of those in lowest income groups, according to the new research. Nearly threequarters of this age group receive half their income or more from State Pension.

“The significance of State Pension Age on most people’s lives should not be underestimated – for many it marks the point where people can finally afford to step back from work and it provides the financial bedrock for later life,” said Stephen Lowe, group communications director at Just Group.

“The rise in State Pension to 66 by 2026 is now underway and, coupled with the planned rise to 67 by 2028, these changes are likely to have a major effect on the labour market. We can expect to see the growth in the number of older workers make up a large part of the rise in overall employment for the next decade.”

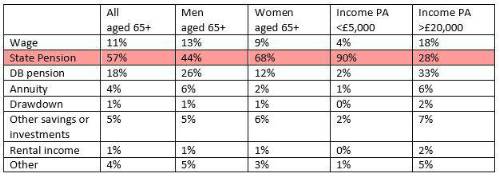

He said the new figures reveal that State Pension is the most significant source of retirement income, especially for women and those on low incomes. It is the largest income source for all groups, except those with annual incomes of more than £20,000 who receive a higher proportion of their income from defined benefit pensions than the State Pension.

Where does the income of people aged 65 or older come from?

The research also revealed that nearly two (65%) in three aged 65+ started thinking about being able to afford to retire before their State Pension Age, while about one in five (18%) said it was once they reached State Pension Age. And while only 15% of those aged 65+ said they were able to retire completely living off the State Pension, 57% said that State Pension combined with their own savings/pensions had allowed them to retire. Others said receiving it had supplemented their income but they still needed to work (8%) or it had allowed them to go part time (7%) or switch to a less stressful/more enjoyable job (3%).

|