Mike Ambery, Retirement Savings Director at Standard Life, part of Phoenix Group said: “The UK’s average earnings increase of 4% is important for state pensioners as it’s practically guaranteed to be the determinant of next April’s pension uplift. Under the triple lock, yearly state pension increases are determined by the higher of September’s inflation (announced in October), which is forecast to come in quite a bit less than 4%, the average of UK wage increases between May and July, and 2.5%.

“With the government holding fast on its commitment to the triple lock, it looks likely that the 2025-26 full new state pension will be £11,962.60 a year, up £460 on this year’s payment.

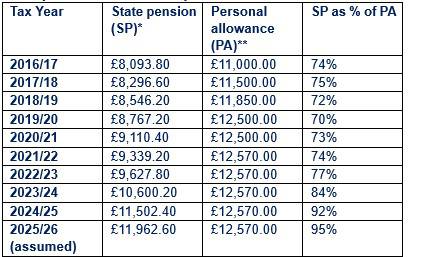

“This inflation-beating uplift will be some comfort for pensioners grappling with high energy prices and, for those not claiming pension credit or other benefits, staring into their first winter without the £300 fuel allowance. However, a new state pension of £11,962.60 will also be 95% of the personal allowance, currently frozen at £12,570 until 2028 – by contrast, in 2021/22 the new state pension was equivalent to 74% of the allowance. This means pensioners will need just £607.40 of other income before paying income tax.

“The personal allowance rose fairly rapidly as a percentage of average earnings in the just over a decade before 2020, from 23.61% in the 2007-2008 tax year to just under 45% in 2020. Since 2020, a combination of freezes and inflation has seen this decline meaning a greater percentage of income is taxable*.

“For pensioners paying the higher rate of tax, the value of the £8.85 rise will be eroded to around £5.”

State pension as % of the personal allowance

Source – *Full state pension; **Personal allowance figures

*https://ifs.org.uk/taxlab/taxlab-data-item/personal-allowance-over-time

|