-

Growth of flexi-access drawdown means many retirees are now shouldering investment risk themselves

-

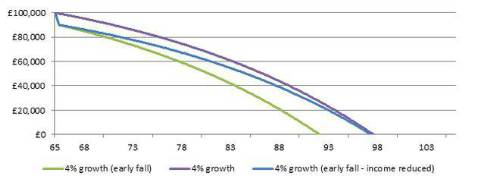

To mitigate this risk this retiree would have to reduce their income by 9% for the rest of their retirement.

-

At retirement investors don’t have to choose between the risk of drawdown and the inflexibility of annuity as guaranteed drawdown offers an alternative

Duncan Jarrett, Managing Director, Retail at Aegon comments on the challenges and options for at retirement investors:

The pensions freedoms introduced by the government on April 6th mean that an increasing number of retirees are choosing to keep their pension pot invested in the stock market, whilst drawing an income. The challenge of this approach is that market downturns have a painful impact of the value of those savings and consequences for how much income people can afford to take. This is an emerging issue, given that in the past the vast majority of people converted their savings into an annuity, which offers income certainty but limited flexibility.

If we take the example of someone who moved their pension pot into flexi-access drawdown on April 6th and invested in a multi-asset portfolio, they may well have seen the value of their pot decline over 10% in the last five months.

Given that the market downturn has occurred early in retirement when the pension pot is at its biggest, such a fall has particularly unwelcome consequences. If the market does not bounce back in the coming months – and merely grows at a typical underlying rate of 4% - the individual will need to look carefully at the amount of income they are taking. For example, if the retiree began with savings of £100,000, a multi-asset investment and annual withdrawals of £5,500 on April 6th, and the value their investment does not recover, their savings will be exhausted five years earlier than expected. That retiree would need to reduce their subsequent income by £500 a year, or 9%, to compensate for the impact of this market fall early in retirement.

Investment and income decisions like this are increasingly common as more and more people opt for the flexibility of drawdown over the certainty but inflexibility of an annuity. However it comes with the risk that retirees may be forced to reduce their income early in their retirement journey. There is an alternative in the form of guaranteed drawdown which provides the income certainty of an annuity and the flexibility of drawdown. Aegon’s Secure Retirement Income enables investors to keep their pension pot invested but with a minimum level of retirement income guaranteed. As a result, when markets fall customers know their income is protected, but they can also capture market growth if stock markets rebound.

|