Steven Cameron, Regulatory Strategy Director at Aegon: “The FTSE 100 is down almost ten percent in the last six months and drawdown investors taking advantage of the pension freedoms introduced last April will have experienced a bumpy ride of late.

“The challenge of volatile markets can be particularly severe for those in early retirement when pension pots are at their largest. If people continue to take a fixed monetary sum each month, they end up reducing the size of their pension fund and limiting its ability to recover when markets bounce back.

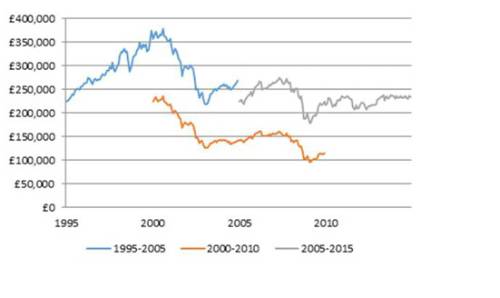

“If we take a hypothetical scenario in which markets grow steadily at 4% each year over the course of a retirement a £225,000 pension pot from which a 65 year old retiree withdraws an annual income of £13,600 will be exhausted by age 92. However, if the stock market falls 30% over two years in early retirement and they continue to withdraw £13,600 it will last to just age 80.

“This highlights just how important it is to adjust your retirement income to reflect the markets. Rather than taking a fixed annual income, drawdown investors may well be safer taking a percentage sum. A fixed percentage of say 4% may offer a more variable income but it prevents the investor from exhausting their savings in those periods where the value of their savings is falling and could benefit them longer term.”

Graph showing performance of a £225,000 pension pot over three separate 10 year periods in which the investor takes an annual income of £13,600. The graph highlights just how important timing is and for those who retire into volatile markets, just how easy it is to run down a pension pot if you’re unlucky with market timing

|