.jpg)

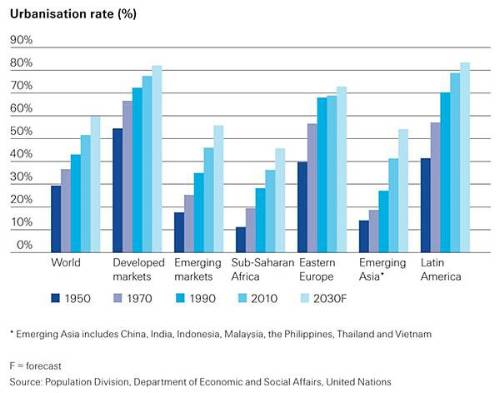

The world's urban population is forecast to grow by about 1.4 billion to 5 billion between 2011 and 2030, with 90% of the increase coming in the emerging markets. Swiss Re's latest sigma study 'Urbanisation in emerging markets: boon and bane for insurers' reviews the rapid growth of towns and cities in emerging markets. It also addresses the opportunities and challenges that urbanisation presents with respect to risk management for insurers and governments alike.

China and India at the forefront of urbanisation wave

Asia and Africa will see the biggest rise in urbanisation rates in the coming decades, as well as in urban populations.

"It's estimated that China will account for 20%, that's 276 million people, and India for 16% or 218 million people, of the increase in the global urban population between 2011 and 2030," says Amit Kalra, co-author of the sigma report.

A prominent feature of the urbanisation will be rapid growth of small and mid-sized cities alongside ongoing development of urban clusters. The number of 'megacities' – those with more than 10 million inhabitants – in the world will rise to 37 from 23 in the same period. Nineteen of these will be in emerging markets, with 13 in China and India combined.

Urbanisation presents new insurance opportunities

The need to accommodate ever-growing emerging market urban populations will entail huge infrastructure investments, estimated at USD 43 trillion (in 2012 constant dollars) between 2013 and 2030, and yield a projected USD 68 billion in construction cover premiums. The development of urban/industrial clusters and expansion of production facilities will likely drive demand for commercial insurance. The aviation, engineering and liability insurance sectors should also benefit.

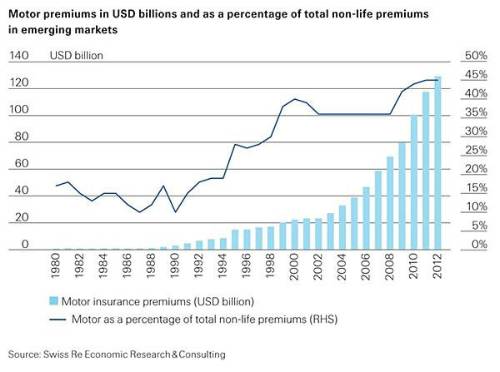

Rising levels of income and asset ownership generated by urbanisation should drive strong growth in non-life personal lines, including motor and homeowner insurance. In 2012, motor insurance accounted for 45% of the total non-life premiums written in emerging markets and further growth is forecast, based on an expanding middle class and increased demand for large-scale logistics services.

The main re/insurance opportunity will likely be in emerging Asia, where the urbanisation rate is lower than in Latin America and in Central and Eastern Europe. China and India are expected to account for around half of emerging-market infrastructure-led commercial insurance opportunities.

The life insurance sector stands to benefit too. The increased levels of education and financial literacy associated with the urban environment relative to rural living can facilitate sales of more complex life insurance solutions such as wealth accumulation and wealth distribution products.

"Traditional life insurance, such as term life, will also do well as households seek to protect the income flow of the primary breadwinner," adds Kurt Karl, Swiss Re Chief Economist. The higher participation rate of women in the workforce empowers a prospective new client segment for life insurance products.

The evolving lifestyle habits in urban areas, with an increase in 'urban diseases' such as cardiovascular illness, lung cancer and chronic obstructive pulmonary disease, and the greater risk of transmission of communicable diseases in high population density areas, will support strong growth of health insurance. Demand for long-term healthcare solutions is also set to rise, particularly for an ageing population less able to rely on the younger generation for post-retirement support.

The challenges of city risk management

Urbanisation brings fundamental socio-economic change and a new risk landscape. With higher population density and concentration of assets, towns and cities are more vulnerable to health hazards and prone to large losses should they be hit by natural disaster events. Furthermore, there is growing recognition amongst policymakers in emerging markets of the importance of providing migrants adequate access to basic needs such as shelter, healthcare and schools.

Recently, more attention has also been given to environmental issues such as air and water pollution. From an implementation perspective, re/insurers can bring their expertise to partner with governments and local municipalities to manage the challenges facing modern cities. Risk transfer to the private sector can be an integral part of city risk management to help alleviate the financial and personal burden that can strike many in the wake of a catastrophic event.

Gabor Jaimes, Head of Property Product Management Asia-Pacific: "Urbanisation is leading to enormous concentrations of property values – particularly in high growth markets. Given the still very low insurance penetration in those markets, this can result in a massive gap between potential economic losses and insurance payout, if such a metropolitan city is hit by a natural disaster. It is important that insurers work with other stakeholders to improve risk coverage to reduce the potential financial burden to governments and individuals arising from natural catastrophes."

Reinsurance can also support local insurers in emerging markets manage capital and risk exposure. In order to remain solvent, domestic insurers need to have adequate capital or use reinsurance to be able to cope with large-loss events. Risk adjusted pricing is often a challenge for insurers in emerging markets given poor data quality on historic losses and lack of modeling experience on potential risk exposure.

|