|

|

By Guy Carpenter

Introduction: An Evolving Issue

Despite its nominally European focus, Solvency II presents a wide range of considerations - and opportunities - to insurance entities worldwide. This new regulatory framework will enact a fundamental change in the way the European insurance industry looks at risk and risk management practices, as it will force the convergence of all aspects of risk quantification with those of business decision making. All businesses that have operations, subsidiaries or affiliates in Europe, write coverage in Europe or do business with insurers in Europe should be preparing now for these wide-ranging changes.

While the final form of Solvency II has yet to be ratified, much preparatory work and analysis has been completed. It is clear that the framework will be built on three fundamental pillars. Pillar I addresses the quantification of capital requirements for insurers. Pillar II focuses on governance and risk management and Pillar III deals with disclosure and transparency requirements.

This paper is the first in a series of Guy Carpenter briefings examining Solvency II and its attendant issues as they are finalized over the next several months. This paper focuses on Pillar I, while subsequent briefings will cover Pillars II and III as well as the special counterparty risk considerations for reinsurers.

While the new framework will impose sweeping changes that will affect virtually all insurers doing business in Europe, companies that are dedicating resources to understand the new requirements and make the necessary preparations can succeed – even excel – under the new regulatory regime.

Timeline: Transitioning to Solvency II

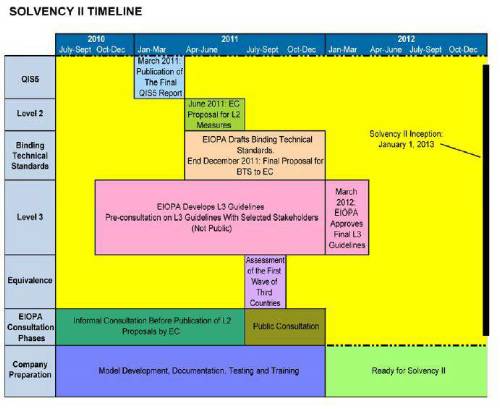

While the official implementation date isn’t until January of 2013, the process for defining and adopting these sweeping regulations is already well underway (see Figure 1).

Solvency II is being developed under the European Union’s (EU) Lamfalussy process1. The different stages of this process have been managed by the Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS, now known as EIOPA, for European Insurance and Occupational Pensions Authority), which has met with the different stakeholders and developed recommendations. These recommendations are then reviewed by the European Commission (EC),which has the authority to define the final principles and is set to enforce the directive in January of 2013.

Alongside this, companies and regulators are heavily engaged in digesting Solvency II’s fifth Quantitative Impact Study (QIS 5). This is the last in a series of test studies used to develop the standard formula, which will be the basis for determining the Solvency Capital Requirement (SCR) for EU insurers and reinsurers. The results are expected to be released in March of 2011.

Final implementation measures are still being discussed and will determine the ultimate form and impact of this new regulation.

Companies need to address several key issues to ensure that they are ready for Solvency II. These may include building and documenting an internal model that is embedded within the entity’s enterprise risk management (ERM) framework to meet the use test requirements.

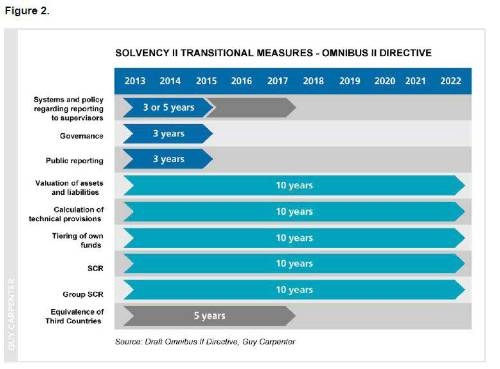

The implementation of Solvency II is likely to be executed transitionally. On January 19, 2011, a provisional draft of the so-called Omnibus II directive was published, which will, if adopted, amend the Solvency II directive to provide for a phased rollout. Omnibus II proposes a number of areas where the EC may adopt transitional measures and sets out the maximum duration of those measures (Figure 2).

Moody’s Investors Service called the Omnibus II proposals "broadly credit positive" for the European (re)insurance sector, allowing a smooth transition to the new Solvency II regime that avoids market disruption. Still, the transitional approach should particularly benefit smaller companies, as they were likely to face the biggest challenges in fully meeting the new solvency capital requirements in January of 2013. The Omnibus II proposals buy them more time; in some areas, up to ten years.

In February of 2011, Dominic Simpson, senior credit officer at Moody's, said: "Transition measures should enable smaller companies to progressively adopt the new standards. Conversely, larger, more sophisticated groups who are already well prepared for the switch would lose a potential competitive advantage."

Industry-wide preparations for Solvency II are not consistent for all companies or across various European jurisdictions. A PwC survey published in November of 20102 indicated that there is a fairly even split between the respondents who have Solvency II projects underway and those who are just at the initial stages. Activities typically done in the early stages are the gap analysis and the implementation plan. Companies still in preparatory stages are generally smaller firms, or smaller entities within groups (not material to the overall group). Geographically, the most advanced respondents (defined as those who range from 51 percent to 75 percent complete) are based in France, Germany and Belgium.

Pillar One’s Impact on Insurers

The first pillar of Solvency II is the quantitative component of the new regulations. It deals with the capital requirements of insurers wishing to provide coverage in the EC markets.

Minimum Capital Requirements (MCR) and Solvency Capital Requirements (SCR)

Solvency II contains two levels of capital requirements: the Solvency Capital Requirement (SCR) and the Minimum Capital Requirement (MCR). The SCR is a target level of capital, while the MCR is a minimum threshold below which companies will no longer be permitted to trade. If the available capital lies between the SCR and MCR, it provides an early indicator to the supervisor and insurance company that action needs to be taken.

To comply with Solvency II, companies may calculate SCR using the standard formula that is provided within the requirements themselves, or they may demonstrate to the regulators that their internally developed, bespoke models meet the regime’s requirements. This internal model versus standard formula distinction is a major consideration for all companies preparing for Solvency II. The option that is chosen will vary on an individual company basis, but in general terms, we expect larger companies – with more in-house administrative, legal, compliance and clerical resources – to opt for the internal model, while smaller companies with limited resources likely will adopt the standard formula or a partial internal model.

Resources Are a Major Factor

Greater pressure in preparing for Solvency II falls on companies that may be smaller, less diversified and with more limited resources. The information technology (IT) support, for example, may not be available to all companies who need to demonstrate sufficient data quality in the process of obtaining regulatory approval for their internal models. These companies may also have lower levels of diversification and potentially more volatile or insufficient data to develop and use internal models. This may be exacerbated for companies such as mutuals without easy access to additional capital.

Resources are also an issue for the regulators themselves, who are charged with enforcing Solvency II and must have proper levels of capacity to audit and sign off on the models. It is likely that these needed levels of resources will not be fully achieved by the time Solvency II comes into effect.

Implementation Issues Differ By Insurer Category

Solvency II’s impact and implementation process depends on the size, sophistication and business mix/level of diversification of a given company. There are three classes of insurers that may encounter different experiences in the implementation and the impact of Solvency II.

Niche Players - Niche insurers are companies that may be monoline players or are less diversified in terms of lines of business or geographic coverage. For these companies, the standard formula may be quite punitive, creating an incentive - or even an absolute need - to put in place a partial or full internal model. Depending on their size, they may also have lower levels of resource availability to address Solvency II, further complicating the situation.

Companies that do not implement an internal model are expected to face higher capital charges. They may need to take steps to mitigate these requirements. They can opt to bring in additional capital (at a cost) or strategically divest certain lines of business through the purchase of reinsurance protection. These options may include loss portfolio transfers, adverse development covers or other types of run-off protections. They can also choose to enter new lines of business in order to diversify their writings and consequently achieve lower marginal capital requirements.

Small to Mid-Size Players (revenues below EUR5 billion) - These companies are generally expected to use the standard formula for the short term and will later begin a concurrent implementation of their own internal model. Using the standard formula spreadsheet, the calculation of capital requirements can be done fairly quickly without a large resource dedication. Development of an internal model, as discussed, requires a larger resource commitment from both staffing and financial perspectives.

There are other factors that may steer a company away from development of an internal model. For example, Solvency II may be seen as a purely regulatory requirement with no resultant impact on profitability. There may also be uncertainty related to receiving approval of the internal model and the length of time required to receive the approval.

In some instances, it may be beneficial for certain companies to opt for the standard formula permanently. The risk charges behind the standard formula are by definition meant to be conservative, but this may not turn out to be the case for all companies. In fact there may be cases where this approach will actually provide lower capital charges than those produced through an internal model. (This overly positive assessment, however, may lead some companies to make inappropriate decisions about risk and capital management, which potentially could create directors and officers liability exposures for these companies.)

Large Global Players (multiline, reinsurers, revenues over EUR5 billion) - Large global (re)insurers are typically opting for an internal model approach, and many are already in a pre-application phase with regulators as part of the Internal Model Approval Process (IMAP).

These companies are currently facing Solvency II-related resource burdens, particularly around documentation requirements and transparency of the model. They will also face choices about which facets of the implementation work should be outsourced versus performed in-house.

Quantitative Impact Studies (QIS)

A series of field tests have been implemented to help companies and regulators preview the impact of Solvency II on capital levels. In the latest of these (QIS 5), preliminary feedback from companies revealed a need for further refinement and improvements to the Solvency II regime. This led the CEA (the European insurance and reinsurance federation) to call on European regulators in February of 2011 to effect the necessary adjustments.

The test results revealed the complexity of certain calculations and requirements. They showed that the standard formula has become so complex that it would no longer be feasible for some companies to implement.

The tests also demonstrated a need to ensure the correct treatment of short-term market volatility, an issue of particular concern to life insurers - and a key consideration regarding the capital charge for non-life underwriting risks, especially catastrophe risks. Solvency II is expected to create greater volatility to non-life earnings and balance sheets, as non-life liabilities will be marked-to-market and calculated on a best estimate basis. Many of the conventional smoothing mechanisms used by non-life insurers may no longer be effective or possible The QIS 5 exercise further showed that Solvency II may put pressure on mutual insurers, many of which may have benefitted from the low capital requirements under Solvency I, in addition to the earlier regime’s being less dependent on rating agency models.

QIS 5 results are to be released in March of 2011 and many stakeholders hope they will provide new and valuable insight into the aspects of Solvency II that may need to be amended and improved.

Cost Considerations

Solvency II is more than a regulatory process; it represents for insurers the need for a new perspective on how to manage their businesses. It undoubtedly also will have an impact on the competitive landscape by affecting different companies, lines of business and geographies in different ways.

Ultimately, Solvency II will present a huge capital burden to the industry. Implementation costs are a major additional expense in an environment where insurers are already struggling to maintain profitability during an inopportune time in the underwriting cycle. The ultimate goal of the initiative is to create a more secure and safe environment for policyholders, however, the substantial costs to the industry as a whole are such that the more immediate impact may be the exact opposite of what was intended.

Indeed, the overall implementation costs for Solvency II are difficult to overstate. The November 2010 PwC survey indicates that the industry-wide Solvency II implementation cost is on course to exceed the European Commission’s estimate of EUR3 billion3. Lloyds of London is expecting to spend GBP250 million in total on implementation, with annual ongoing Solvency II related expenses of about GBP60 million to GBP70 million. Multinational insurers in the UK have set aside roughly GBP100 million for Solvency II implementation.

Adding to the expenses associated with implementation, (re)insurers must also consider the following additional Solvency II-related costs:

Model Approval and Ongoing Compliance Costs

The expenses incurred by regulatory bodies in enforcing Solvency II will, naturally, be passed on to the industry.

In the UK, for example, the Financial Services Authority (FSA) will levy over GBP34 million in fees against insurers in 2011 and 2012 to cover its costs of implementing the Solvency II regime. The fees aim to cover the expense of approving insurers' internal models as well as other related costs. The total FSA cost of implementing Solvency II over the lifetime of the program remains in the anticipated range of GBP100 million to GBP150 million. The FSA’s proposed annual funding requirement for regulated firms in 2011 and 2012 is GBP500.5 million.

Cost of Additional Capital Levels

The cost of maintaining required levels of capital will rise substantially under the Solvency II regime.

The capital requirements promulgated by QIS 5 for non-life insurers (before diversification) have been raised overall by approximately 15 percent over QIS 4 and are approximately three to four times greater than Solvency I capital requirements. The increase reflects the risk-based nature of Solvency II (as opposed to the simple premium/claims-based factors of Solvency I), and, not surprisingly, varies greatly by line of business. For example, capital requirements for nonproportional lines are five to six times greater than those for Solvency I levels. Those for motor insurance are one to two times greater.

For life insurance, the change in capital requirements also differs across product types. Consequently, the relative profitability and economic attractiveness of specific products will change under the new solvency regime. Higher capital requirements are expected for participating products in contrast to other life products. In general, the total resource requirement (the sum of technical liabilities and SCR) for traditional participating life products increases. At a company level, however, the impact depends very much on the capital surpluses and buffers available for participating/with profit policies.

Other Costs

Various recruitment firms have stated that cost overruns may be driven in part by a severe shortage of actuarial staff, forcing insurers to pay 20 percent more than usual to attract and retain skilled personnel for the project. Meanwhile, the PwC survey indicates that over 20 percent of respondents believe that most of their costs will relate to the IT infrastructure spend required to meet Solvency II requirements.

In addition to hard, quantifiable costs, companies also are likely to incur significant opportunity costs relating to the staff resources that will have to be diverted from the ongoing work of the company to focus on this compliance initiative. Development of the internal model, especially, will necessitate high levels of dedicated staff resources. The cost in human capital - and lost opportunity - will be considerable.

Challenges and Opportunities

It is clear that Solvency II presents a host of challenges to (re)insurers. With a disciplined and thoughtful approach, many companies will see opportunities to lessen the impact – or even to improve their competitive stance in the industry. Below we explore in detail some of the key considerations, challenges and opportunities associated with Solvency II.

Reducing Risk – and Required Capital Levels

While QIS 5 demonstrated that Solvency II generally will require higher capital levels across the board, there are steps that non-life insurers can take to mitigate their potentially higher capital requirements. Foremost among these is a reduction of their risk levels, which can be achieved in a number of ways:

Reinsurance Solutions: Companies may utilize reinsurance solutions by adjusting their levels of nonproportional and proportional reinsurance to reduce tail risks. The reinsurance program can be structured to specifically target areas that contribute most to higher capital requirements, while maximizing the acquired capital to cost ratio.

Some estimates suggest the response to Solvency II could increase demand for reinsurance in Europe by 10 percent to 20 percent4. It is expected that the bulk of this demand would come from smaller non-life primary insurers with limited geographical or business line diversification and inadequate resources to implement more sophisticated internal models. Better capitalized, or “Solvency II ready,” primary non-life insurers are also likely to review their existing reinsurance arrangements, given the potential for greater volatility in their balance sheets.

Other Risk Mitigation Techniques: The reduction in risk achieved with the use of insurance linked securities (ILS) can be recognized in Solvency II calculations, subject to regulatory approval. Options such as surplus relief or tailored nonproportional protection against extreme losses may also be considered.

Diversification: Another risk-related capital management strategy is the maximization of the diversification benefit of different business lines. This can be achieved in a number of different ways, including mergers and acquisitions (M&A). Companies may also seek to enter new business lines through organic means or by forming new distribution partnerships. This action is advisable only where there is a strategic rationale and where the insurer has expertise or experience in the line of business it is entering - for example, a scenario where a personal lines motor insurer enters personal lines home insurance. The action would not be advisable to undertake for the sake of maximizing the diversification benefit alone.

Market Risk: Market risk can be reduced through deployment of hedging strategies on the equity portfolio, or through reduction of the equity allocation in favor of corporate bonds.

Change in Focus for Companies and Boards

The Solvency II regime is increasingly being perceived as more than a “check the box” regulatory exercise that determines capital requirements. It requires the European insurance industry to critically analyze its risks, and in the process, assess the true costs attached to them.

Luke Savage, finance director and head of risk management at Lloyd’s of London, commented on the dozens of people and hundreds of millions of pounds that Lloyd’s is committing to Solvency II, saying, “If you're putting that kind of investment into it, you've got to get some value out of it - it can't just be a regulatory exercise or we've all missed the point.”5

The Solvency II regime goes further than just capital requirements; it demands and rewards good data management, good enterprise risk management and good culture, which ultimately will please investors. In theory, this means the industry will be far more aware of its risks at all levels, better able to manage its risks and consequently better placed to optimize returns on capital.

In fact, Solvency II is likely to precipitate a fundamental shift in focus for insurance entities away from pure underwriting results onto capital and risk management. It likely will change the responsibilities for corporate boards - which will expressly bear responsibility for compliance with the various Solvency II regulations.

The PwC Solvency II survey indicated that more than 80 percent of respondents see Solvency II as an opportunity to improve risk management and 65 percent believe that it will facilitate more effective use of capital. Additional survey results showed that 25 percent of respondents saw Solvency II as a mechanism for gaining competitive advantage.

Drawbacks to the Standard Formula

As discussed earlier, (re)insurers are faced with the important decision of whether to develop their own internal model or use the standard formula supplied by regulators.

Generally, the standard formula represents a “generic” (re)insurer. It is designed to encompass a wide “one size fits all” range of all possible risk profiles in its parameters. This lack of specificity to the profile of a specific company increases the likelihood that inappropriate - or at least suboptimal - results will emerge for many insurers that use it.

The use of internal models, however, should encourage insurers to better identify and manage their risks. Larger insurers using internal models are expected to benefit largely from this. However, the benefit will be somewhat mitigated because the standard formula will have to be run parallel to an internal model for at least two years, causing a potential strain on resources.

Larger insurers prefer to avoid using the standard formula for various reasons. One concern is with its risk-factor approach to calculating capital requirements, which does not properly differentiate the risks in a portfolio. Diversification between lines of business and geographic regions is also not adequately recognized.

The standard formula also is perceived to take the insurance underwriting cycle into account inappropriately. Premium volume is used as a simplified measure of exposure in its calculations. If the market hardens and premium rates are increased, the standard formula treats this as increased exposure and hence increases the level of capital required to support this business. This approach does not reflect the risk characteristics and true exposures undertaken by the insurer.

One of the most widely criticized aspects of the standard formula calculation is the use of the market loss-market share approach, where an insurer calculates its loss size depending on its level of participation in a particular market. This approach is only adequate for larger companies with risk profiles that are similar to the market as a whole. This approach may heavily distort results for smaller players who have a significantly different distribution of risks within the market.

Finally, there are various restrictions under the standard formula limiting the effect of reinsurance. For example, under proportional reinsurance, the standard formula does not allow the cedent to benefit from a cover which contains certain features such as event limits, loss corridors or loss ratio caps, to name a few. For nonproportional insurance, only certain types of excess of loss contracts can be taken into account – and they must satisfy various standard formula criteria.

Diversification Versus Divestiture

Solvency II’s impact on capital is expected to be significant for most insurance entities - but potentially insurmountable for others. Small and mid-size firms - particularly monoline writers - will be the most vulnerable. Depending on their ability to raise capital, they may have limited options on how to meet the heightened capital requirements.

One obvious solution to meeting additional capital requirements is to increase reliance on reinsurance. Alternatively, firms may also be able to impact their capital charges by either increasing writings on a more diversified portfolio or simply divesting their participation in some lines of business where capital charges exacerbate potential returns.

Diversification is expected to become a major component of capital requirements, potentially reducing the capital charges by 25 percent to 35 percent. Since the standard formula does not provide the flexibility to reflect the true value of diversification, maximizing this effect will typically require the use of an internal model.

The impact of diversification varies significantly between different types of companies. Composite insurers are expected to benefit the most, owing to the low correlation between their mixed life and non-life risks. Reinsurers benefit because of their typically wide range of reinsured risks and geographical diversification. Reinsurers that write both life and non-life lines should receive an even more pronounced benefit.

The lack of geographic diversification of some mutuals is an important issue that dominated the discussion of treatment of mutuals under the Solvency II regime. One possible solution may be to allow mutuals to regroup across country borders in order to receive the benefit of geographical diversification.

Finally, the advantages of diversification are likely to generate incentives for mergers and acquisitions within the industry.

Mergers and Acquisitions Opportunities

Mergers and acquisitions (M&A) activity among insurers is expected to increase under Solvency II. Some insurers may divest assets due to difficulties in raising the extra capital required under Solvency II. Others may merge in order to change their operating models to facilitate Solvency II compliance. The calculations of capital requirements under Solvency II will be conducted pursuant to a group-based approach, which could spur M&A activity as insurers seek to create groups with optimal (from a capital requirement perspective) risk profiles.

Another factor affecting M&A among (re)insurers is the need to acquire the significant resources required for establishing and maintaining internal risk-assessment models. More detailed data analyses on new or more sophisticated IT systems may be required to run the capital requirement calculation and designated scenarios – and buying this capability through an acquisition may be more expedient than building it in-house.

Impact on Asset Prices

Under Solvency II, each insurer will have to consider the trade-off between the expected return on its investment portfolio versus the cost of capital required to cover the investment risk. If the cost of capital exceeds the expected return, the insurer will probably try to reduce the level of investment risk by reallocating into lower-charge investments.

A sudden reallocation by all insurers to a class of investments such as fixed income securities would inevitably cause its prices to increase sharply. This is likely to be particularly acute in the market segments with relatively low liquidity. A rise of fixed-income prices would imply a decline in corresponding yields, which, all else being equal, would imply a lower cost of capital. Taking into account the increased focus on asset-liability matching under Solvency II and the fact that the duration of the insurance portfolios of life insurance companies is quite long, the impact would be most pronounced in longer-dated securities.

Availability of Insurance Products

Under Solvency II, certain lines of business may become unprofitable for insurers to underwrite due of their higher capital requirements. Consequently, insurers may stop or reduce sales of these products. Any resulting “uninsurable” economic activities could, however, be mitigated by raising rates on the associated products, modifying the nature of some products or constructing "risk sharing" solutions among insurers such as swaps.

Reinsurance Solutions That Work … and Others That Don’t

Tailor-made reinsurance solutions may be sought by market participants to ensure effective risk management and reduction in required capital levels. Insurers with different needs and strategies will look at different routes depending on the types of portfolios they have. These include the following:

Proportional treaties could be employed to reduce concentration and thereby increase diversification of the portfolio, which would free up capacity to write other lines of business.

Nonproportional covers could be used to reduce volatility of claims experienced along with the associated capital charges.

Aggregate excess of loss covers could be used to limit frequency of claims.

Industry loss warranties (ILS) or insurance linked securities (ILS) could be used as supplemental and perhaps more cost efficient sources of protection against major catastrophe risks. A proper quantification of the basis risk found in these types of cover could provide additional capital relief. Collateral available in these transactions reduces the counterparty risk.

Structured covers could free up regulatory capital for holding against loss reserves. These include loss portfolio transfers, adverse development covers, and run-off protection.

Additional forms of alternative risk transfer mechanisms will also emerge as Solvency II unfolds. The impact of these may need to be tested and approved, and the level of risk reduction they offer will be subject to regulatory approval.

Reinsurance Under the Standard Formula Approach - Premium and Reserve Risk

The calculation of the standard formula is driven by premium and reserve volumes that are incorporated through risk factors. In general, the use of proportional reinsurance in a standard formula scenario is a good method for reduction of capital requirements through the lowered exposure to a particular line of business.

However, the benefits of proportional reinsurance cannot be accurately reflected in the standard formula when various contractual features - such as sliding-scale commissions, loss ratio corridors, aggregate limits or caps - are present in the contract. There is also no allowance for the level of ceding commission payable, which impacts the real benefit of the cover.

In the standard formula, the effect of nonproportional reinsurance could be factored in through adjustments of the premium risk standard deviation. However, the adjustments are limited to the number of possible reinsurance alternatives that could be used to reduce the level of capital required. Significant restrictions under excess of loss reinsurance also apply:

It must be on a per risk basis.

It must allow for reinstatements.

It must cover all insurance claims under the particular segment considered.

It must meet all other requirements for risk mitigation set out in QIS 5.

It must not contain special features such as annual aggregate deductibles or special triggers.

Other types of nonproportional reinsurance - such as aggregate excess of loss or stop loss - are simply not considered under the standard formula.

Reinsurance Under the Standard Formula Approach – Catastrophe Risk

The calculation of catastrophe risk uses standard scenarios for natural catastrophe risk and specific scenarios for man-made catastrophes. Standard scenarios have only been defined for countries within the European Economic Area (EEA). For exposure written outside the EEA, companies are supposed to use a very simplistic factor-based approach, which is likely to result in disproportionately high capital requirements.

Using the standard scenarios, companies can take their individual reinsurance programs into account. Nonproportional reinsurance such as excess of loss catastrophe protection translates to adequate capital relief within these scenarios, but technical limitations exist in accurately reflecting specific contracts such as multi-peril or aggregate protections. Furthermore, applying individualized reinsurance to non-individualized market-wide standard scenarios could result in capital requirements not reflecting the true risk profile of the company.

The Second Installment will be published next week on Actuarial Post, Whilst the latest installment can be seen on the homepage.

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.