MoneySuperMarket analysed thousands of car insurance quotes from 2018 to identify price fluctuations, showing August to be the best value month. The average fully comprehensive policy taken out in August 2018 costs £496, compared to an average of £549 in January 2018 – 10% less.

Additional quarterly data for 2019 highlights a continued competitive insurance market for drivers, with the average fully comprehensive policy staying below £500 for the second quarter running, and cheaper than the same period in 2018.

Between April and June this year, the average price was £472, a slight rise on the first quarter of 2019 when it stood at £466, but £22 less than the average figure during April-June 2018 (£494). Encouragingly for drivers, this is the first time there have been two consecutive quarters when premiums have been below £500 since summer 2015.

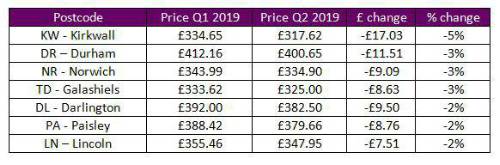

The data is based on analysis of 1.7 million full comprehensive car insurance quotes on MoneySuperMarket between April and June 2019. Motorists in Kirkwall, Scotland saw their premiums fall most during the second quarter of 2019 (5%), from £334.65 to £317.62. Those in Durham, Norwich and Galashiels saw their premiums decrease 3%, while drivers in Darlington, Paisley and Lincoln saw a 2% drop.

East London remained the most expensive place to insure your car, at an average of £935.20 for fully comprehensive cover, while the Isle of Lewis in the Outer Hebrides had the cheapest premiums at an average of £303.47. London as a whole had an average premium of £668, compared to £364 in Scotland.

Prices have also fallen for the two youngest age groups in the last 12 months – by 12% for 17-19 year-olds (now at £993.61) and 5% for 20-24 year-olds (now at £939.72).

Women saw the average cost of a fully comprehensive policy drop by 4% year-on-year (now at £423.36), while men paid an average of £516.15 (down 5%).

Emma Garland, data scientist at MoneySuperMarket, commented: “It’s good to see premiums staying below £500 for the second quarter running and this can be attributed to two things. First, there was a swift drop in the spring last year after the government reduced its calculations for lump sum payments for personal injury claims, which particularly affected younger drivers because they have more accidents.

“The second, longer term trend is the growing availability of black box, or telematics insurance. It is competitively priced and encourages safer driving, so it has helped to keep a ceiling on premiums.

“No matter your age or where you live, it pays to shop around at renewal rather than remain with your existing insurer. Firms usually reserve their best prices for new customers and motorists who explore other options can see significant savings.”

MoneySuperMarket’s Car Insurance Price Index lets drivers see how much car insurance costs in the UK, based on over six years of data and millions of customer quotes.

|