In Parliament today, Richard Holden, MP for North West Durham, will seek to introduce a Private Members Bill to extend auto-enrolment to enact the proposed changes.

The UK government had previously recognised issues with auto-enrolment and had committed to making changes by the “mid 2020s.

However, Aviva is calling on government to put a plan in place now for how and when it will implement the removal of the lower qualifying earnings threshold and reduce the minimum age threshold to 18 years old, for automatic-enrolment.

Emma Douglas, Director of Workplace Savings at Aviva said: “The current auto-enrolment system disproportionately disadvantages younger workers, part-time workers, and those with multiple lower-paid or part-time jobs.

“These proposed changes to auto-enrolment could make a real difference to the future retirement plans of today’s lower-paid and part-time workers as everyone who is in a pension scheme will get a contribution from the first pound they earn. However, the target date of “mid 2020’s” can only be achieved if a road-map is agreed now. Employers and employees need time to plan. The clock is ticking and the longer it does, the less there will be in the pension pots for those who might need it most.”

Lower qualifying earnings threshold

Abolishing the lower qualifying earnings threshold will ensure that every penny counts for those who earn less than the £10,000 auto-enrolment ‘trigger’ threshold but choose to opt into a workplace pension.

Aviva has found that through auto-enrolment, a part-time employee who works two days a week earning the National Living Wage and opts into a pension receives an employer pension contribution of just 15 pence a week into their pension pot. That’s just £7.80 per year, or 0.12% of their earnings. By contrast someone earning an annual salary of £50,000 would receive £1,313 per year- 2.6% of their earnings.

This is because the first £6,240 of annual pay – or £120 a week - isn’t pensionable under auto- enrolment. Which means that those who are paid the least have the smallest percentage of their salary paid into their pension.

This system disproportionately disadvantages women, who are more likely to work part-time, and workers with multiple part-time jobs who have the £6,240 contribution threshold deducted from each employment.

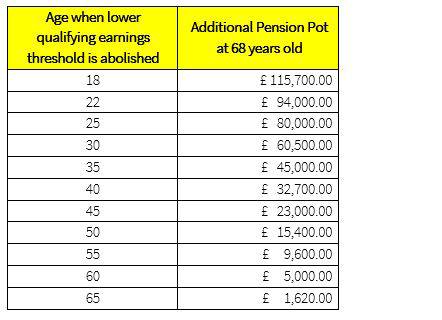

Abolishing the lower qualifying earnings threshold would increase pensionable pay by up to £6,240 per year and total pension contributions by £9.60 per week for everyone who earns more than £6,240 a year. This could mean up to an extra £115,700 in pension pots at retirement.

Table 1: Aviva Data – Additional Pension Pot at retirement, by age

Young people aged 18-22 are also disadvantaged. Auto-enrolment starts from aged 22, meaning that younger workers do not benefit from any pension contributions – unless they choose to opt into a workplace pension scheme. Automatically enrolling an employee into a workplace pension from 18 years old – instead of 22 - will mean that they contribute to a pension for an extra four years. As the first contributions work the hardest, this could result in a 11.5% increase in their total pension savings at retirement. For those on the lowest levels of pay, starting early would make a real difference.

Emma Douglas said: “If we are to truly ‘level- up’ the country and ensure that the young, the low-paid and part-time workers - who are often women - can enjoy a decent retirement, then reforming auto-enrolment thresholds should be central to the Government’s policy programme.”

To ease the financial impact on employers and workers, Aviva supports Onward’s recommendation for a phased reduction in the lower qualifying earnings limit.

Emma Douglas added: “An increase in the cost of living means this year could be financially challenging for many, and long-term savings might not feel like a priority. There is never a ‘perfect time’ to increase pension contributions, but a phased approach should help to ease any sudden financial impact on employers and employees.”

|