The ACA survey, which was conducted over the summer and received responses from 308 employers of all sizes, found:

64% of employers running defined benefit schemes say it will take more than 2 years to fully equalise pensions for the effect of unequal GMPs in their schemes.

43% of these employers say they are ‘likely to opt for GMP conversion’ (method D2) with 31% leaning towards the year on year calculations and dual records (method C), with the remainder undecided.

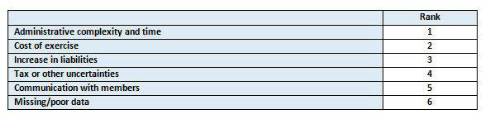

The biggest challenges in dealing with GMP equalisation were ranked by employers as follows:

ACA Chair, Jenny Condron, commented: in this our second report on our 2019 Pension trends survey have underscored employers’ concerns about the expected complexity and additional costs associated with GMP equalisation. It’s perhaps surprising that employers see ‘missing and poor data’ as one of the less significant challenges in addressing GMP equalisation – that’s not a view many of our members would have! We believe many schemes will need to focus resources on their data as a first step in addressing this complex issue, including completing long-running GMP reconciliation exercises.

“The recent guidance issued by the GMP Equalisation Working Group will be helpful to the many employers and trustees who are either totally undecided or who are beginning to grasp the nettle of how they might act. However, before implementing an equalisation approach, many are rightly still awaiting the outcome of next year’s court case to address residual uncertainties and for HMRC guidance on the potential tax implications involved.

“Whilst we are not surprised more employers and trustees are leaning towards the D2 conversion method, perhaps on the basis that ongoing administration will be similar to the status quo, and there is the opportunity to simplify benefit terms too, it’s perhaps surprising that close to a third are favouring method C, the dual records approach. It is to be hoped that this doesn’t reflect a default decision based simply upon the High Court judgement, which favoured method C2. The approaches to be used by employers and trustees need to reflect each scheme’s particular circumstances and an understanding of the short and long term practical and cost implications.

“Given the added burden of such costly and time-consuming GMP equalisation exercises it is not surprising that fewer and fewer employers have any enthusiasm to continue to run ‘open’ DB schemes. Our survey respondents this year report three-quarters of all their defined benefit schemes are closed, with over four out of ten now completely closed to future accrual. The ACA believes that there is a real opportunity to use GMP equalisation as the catalyst to simplify member benefits more widely, reducing ongoing governance costs and potentially improving member understanding. We will continue to press the Government to support DB simplification measures that would be mutually advantageous to employers and scheme members.”

Further reports on the 2019 Pension trends survey’s findings are due to be published over the next two months and a final report in December.

|