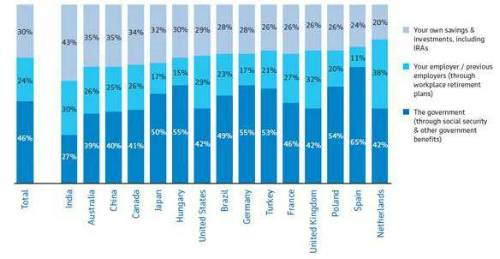

While generous defined benefit schemes have declined the introduction of automatic enrolment in 2012 means people in the UK now expect a third (32%) of retirement income to come from their workplace savings. The survey showed that a further 42% was expected to come from the government, with the remaining 26% coming from their own savings and investments.

The only country to place greater reliance on workplace savings to fund retirement was the Netherlands, with workers there expecting 38% of their total pension income to come from employer schemes. Globally, people expect workplace plans to fund 24% of their retirement income.

Workplace savings were least favoured in Spain with just 11% of retirement income expected to come from employee saving plans. Spain had the greatest reliance on the state, with an expectation that 65% of overall income in retirement would be provided by government benefits.

Globally, the survey found that people expect government benefits to fund nearly half (46 percent) of their retirement income. In six of the 15 countries surveyed, people expect half or more of their retirement income to be funded by government benefits: Spain (65%), Germany (55%), Hungary (55%), Poland (54%), Turkey (53%) and Japan (50%), while in the UK 42% of overall pension income was expected from this source.

The expectation among young UK people aged 18 to 24 is that a much lower portion of their retirement income will come from government benefits (35%) compared to those of pensionable age today (50%). Despite recent announcements regarding future increases in UK state pension age, young people still expect to retire at a median age of 65 which places greater reliance on adequate private provision.

Chart showing the expected proportion of retirement income by source:

Steven Cameron, Aegon UK’s Pensions Director, said: Retirement has long been characterized as a ‘three-pillar’ model with government benefits, employer pensions and personal savings all supporting individuals when they stop working and no longer have earnings from employment. There are significant global differences in the extent to which people expect their retirement income to come from each of these pillars, depending on the retirement system in the country where they live.

“The research shows how each country is reacting to the crisis of an aging population in different ways. The UK’s solution to focus on workplace savings makes it world leading, whereas its decision to increase state pension age is likely to mean expectations from the state pillar remain below the international average. But those countries which place significant reliance on often unfunded government benefits, despite widespread concerns about their sustainability as life expectancy rises, could face issues as future generations approach retirement.

“While UK employees benefit from the workplace pension focus, the ever increasing numbers of self-employed don’t. This highlights the need to focus on how to improve pension provision for this significant element of the working population.

|