By Penny Cochrane, Investment Research Consultant at Hymans Robertson

GSS bonds must have a specific UoP to finance green and/or social projects, whereas SLBs can be for general corporate purposes, but with a potential step up or down in coupon linked to achieving KPIs of broader sustainability metrics. While there is no regulatory oversight, key market guidelines have been issued by the International Capital Markets Association (“ICMA”) covering GSS and SLBs, and most bonds fit within these standards.

GSS bonds

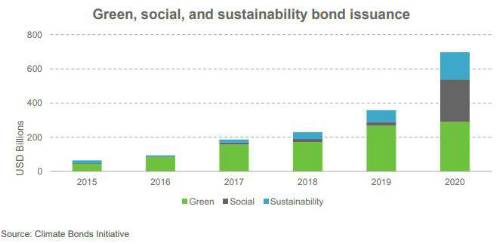

GSS bond issuance is growing strongly with $700bn issued in 2020, approximately 5% of global issuance, while green bonds remain the largest issuance, social bonds have grown in response to the pandemic. There has also been an increase in sustainable bonds, which are a combination of green and social projects in one instrument.

It is important to note that despite ICMA standards in place, there is no enforceability: if an issuer doesn’t deliver in funding green or social projects, there is no impact other than reputational on the issuer.

Green bonds

In 2007 the green bond market was launched with a green bond issued by the European Investment Bank. The green bond market is currently dominated by a few sectors where eligible projects can easily be identified, such as energy, buildings and transport, but new sectors are issuing as well and diversification by sector is becoming easier.

The UK Government has announced that it will issue its first green gilts during 2021 in order to fund low carbon projects, with the first issuance expected in September.

Social bonds

Social bonds are bonds issued with a specific UoP that finance projects with a positive social outcome. The first social bond was offered in January 2015 by the Spanish bank Instituto de Credito. Its objective was to help finance small and medium sized enterprises in economically depressed regions of Spain, with unsustainable companies explicitly excluded. Social bond issuances in 2020 were up a massive 1,022% compared with the previous year, primarily driven by the COVID-19 response.

Sustainability-linked bonds

As mentioned, UoP is not a determinant in defining SLBs. Instead, issuers select sustainability-linked key performance indicators (“KPIs”), which are predefined and should be considered material to the issuer’s business model. There are financial and/or structural features to these bonds that vary depending on whether these KPIs are met. Typically, this equates to a step-down in interest rate, or coupon, if the company achieves its KPIs, and sometimes also a step-up in coupon if it does not.

The SLB market started in September 2019 with an issuance by Enel, an Italian utility, linking its bond coupon to the company’s percentage of installed renewable generation capacity. And the trend is even moving across to the leveraged loan and private debt markets. In Q1 2021, sustainability-linked loans comprised 40% of issuance in the European leveraged loan market2.

However, there are criticisms of SLBs which should be examined, namely that companies choose their own KPIs, and are perhaps not setting KPIs that are ambitious enough, thus ensuring a high likelihood that their interest rate steps down (or does not step up). It also sets up a strange dynamic between issuer and investor where the investor receives a higher return if the issuer fails to meet its KPIs.

Greenium

A new term for investors, the ‘greenium’ refers to the spread premium of equivalent conventional bonds over green bonds, i.e. the overall yield that investors give up. The greenium is not homogenous and depends on a number of factors including maturity, credit rating and seniority of the bonds. Historically, the greenium has been fairly volatile but appears to have settled down during the course of 2020 and, as it is driven by demand, it is expected to lessen as the market grows.

The concept of a material greenium is now more myth than fact. Comparisons of green bonds to conventional bonds show only a moderate greenium, albeit this does increase in sectors where there is greater scarcity of green bonds.

However, demand in the market means the ability to sell GSS and SLB bonds remains elevated relative to conventional bonds levels, for GSS bonds in particular. In addition, money in sustainable debt may be expected to see less outflows and as allocations to sustainable fixed income grow, it should exhibit lower volatility in market stresses.

The Bloomberg Barclays MSCI Green Bond Index has outperformed the Bloomberg Barclays Global Aggregate Index by 0.5% p.a. since inception of the former in January 2014, suggesting that sustainable investing can be done without compromising return.

It is important to note this is not a true ‘like for like’ comparison: some of the biases of the green bond universe drive the difference in performance between the two indices. The indices are similar in duration, but the green bond index has a lower rating (A vs AA).

Green bonds have been dominated by debt issued in Euros and is underweight US dollars relative to the global index; according to Amundi, 67% of issues YTD were Euro-denominated3. The green bond universe also has a higher proportion of corporate debt and less government debt relative to the global bond universe. In practice, many investors to date have taken an active approach and may not need to hold bonds to maturity so they have the potential to benefit if sustainable bonds become more expensive relative to conventional issues.

Accessing the market and impact on portfolio

GSS are essentially conventional bonds with a specific use of proceeds, whereas SLBs are corporate bonds just with a potential step up or down in coupon. Therefore, investors can access both types of bonds through a conventional bond portfolio although there are specialised sustainable managers who are able to offer investors specific portfolios tailored to their specifications. Credit analysis is completed on the issuer as would be expected, with an additional layer of due diligence to assess their sustainable credentials and avoid greenwashing (i.e. labelled as green, but no real link to sustainability).

The GSS and SLB trend is a growing signal of companies’ commitment to environmental or social causes. The sustainable market is quickly growing and is expected to comprise 5% of the overall bond market within a few years.

Finally, it is important to note that a green bond portfolio may not necessarily reduce the headline carbon intensity of an overall portfolio in the shorter term. When measuring the carbon intensity of a portfolio, there is no credit given specifically to the purpose of the green bonds, instead the footprint for the underlying issuer comes through in the data. However, over the long-term, alignment of companies to financing more green projects should reduce any issuer’s carbon footprint.

|