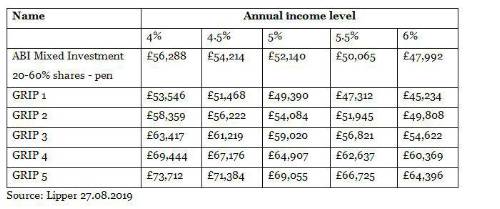

Analysis of the performance of the mutual insurer’s Governed Retirement Income Portfolios (GRIPs) shows that if someone had invested £50,000 in one of the portfolios when they were launched seven years ago and took out an income of between 4%-6% per year, in the vast majority of cases retirees would still have more in their portfolio than they had initially invested.

For instance, someone investing £50,000 in GRIP 3 and taking an income of 4% per year over seven years would currently have £63,417 in their portfolio. Someone invested in GRIP 5 and taking a 4% annual income would currently have more than £73,000 in their portfolio. This compares with a benchmark return of £56,288.

The GRIPs were launched in August 2012 as one of the first investment solutions designed exclusively for customers looking to take a sustainable income from their pension. There are five different portfolios to choose from depending on the clients’ attitude to risk. GRIP 1 is the lowest risk investment mix while GRIP 5 is the highest.

The portfolios are based on a diversified mix of assets designed to capture market upside and respond better to market downturns than a pure growth portfolio. Demand for the portfolios has grown strongly with assets under management currently standing at approx. £3.7bn.

Lorna Blyth, head of investment solutions at Royal London, said: “An income drawdown portfolio can enjoy strong investment growth but if the levels of withdrawals are too high then customers risk running short of money. These figures show that by working with an adviser to keep withdrawal rates at a sustainable level customers can benefit from a resilient income drawdown pot that can weather the storms caused by issues such as trade wars and Brexit.”

|