|

|

At today's Investors' Day, Swiss Re unveils its strategic framework to position the company strongly vis-à-vis current and future opportunities and challenges facing the re/insurance industry. At the heart of the framework is the systematic and fast allocation of capital to access new and existing risk pools and revenue streams. At its Investors' Day, Swiss Re also details how the framework will lay the foundation to meet its financial targets over the cycle. |

• Four-pillar strategic framework builds on current successful strategy, enabling Swiss Re to move to the next stage of its transformation to be an agile capital allocator in insurance and associated asset risks

• Strategic framework centres on systematic and fast allocation of capital into new and existing risks, as well as broadening and diversifying Swiss Re's client reach and optimising resources • It allows Swiss Re to actively differentiate itself in the industry and better positions it to achieve its new financial targets and deliver sustainable, long-term shareholder value • From 2016 the company targets a 700 basis point return on equity above risk free, 10-year US government bonds, and to grow economic net worth per share by 10% per annum

The current insurance environment is challenged by low interest rates, industry consolidation due to continued pressure on profitability margins and volatility in high growth markets. At the same time, low insurance penetration in many parts of the world, for example, create ample opportunities. Proactively addressing this changed environment, Swiss Re will look to its strategic framework both to seize new and emerging opportunities and tackle existing challenges. The framework builds on the successful execution of Swiss Re's current strategy, which has enabled it to deliver a market-leading total shareholder return of 22% on an annualised basis over the last five years.

Michel M. Liès, Swiss Re Group Chief Executive Officer, says: "Since 2011, we consistently outperformed our peers, grew our business and we continue to focus, with only a few weeks to go, on delivering our 2011–2015 financial targets. Past success however is no guarantee for the future and therefore, we actively looked into what will shape our industry going forward. We developed our strategic framework with the trends, opportunities and challenges we identified in mind. As a result, we'll be able to increase our agility and respond more quickly and effectively to change and to drive change ourselves. At the heart of our transformation journey is our aim to be an agile capital allocator in insurance and associated asset risks. We will do this with a strong balance sheet and three Business Units delivering on their core strengths, such as expert underwriting and solid client relationships."

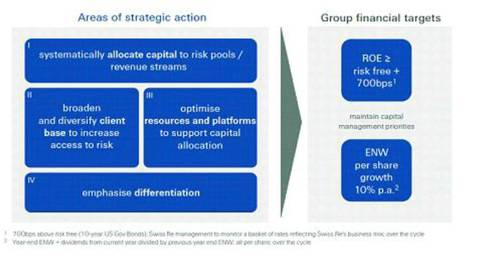

Swiss Re's strategic framework at a glance

Swiss Re's strategic framework rests on four core pillars that are designed to enable the company to achieve its financial targets:

I. Systematically allocate capital to risk pools/ revenue streams

At the heart of the strategy is allocating capital among different liability portfolios and strategically aligning assets accordingly.

This is key for generating shareholder value and will drive outperformance. Swiss Re has defined a target portfolio in line with its liability and asset risks appetite. Examples include natural catastrophe reinsurance, mortality, health and longevity risks. Swiss Re will allocate either more or less capital to each portfolio according to various profitability metrics, and it may also add or discontinue portfolios. This framework is designed to enable Swiss Re to actively steer its risk selection to have the right portfolio mix. Swiss Re will continuously optimise this mix.

II. Broaden and diversify client base to increase access to risk

Swiss Re aims to execute on its capital allocation by having unique access to attractive risks. Geographic diversification is one way of doing this. A current strength already, it will remain a core part of the strategic framework. Between 2012 and 2014, the share of premium and fee income earned from targeted High Growth Markets increased from 15% to 27% of total premium and fee income. Swiss Re aims to increase this figure to 30% by 2020 to maintain its current market leadership.

Another way to access attractive risk pools is by broadening the existing client base and by engaging with new clients. For example, Swiss Re will seek to build on the success of the Global Partnerships public sector team, which works closely with governments and multilateral institutions to help manage previously underinsured risks, or 'protection gaps'. In addition, dedicated growth initiatives targeting regional and national insurance companies in our Reinsurance business, mid-size corporates in the Corporate Solutions business and new distribution partners in Life Capital are another way to increase access to risk.

III. Optimising resources and platforms to support capital allocation

Swiss Re will succeed when it has the right people in the right place, as well as establishing efficient platforms and processes to support its strategic capital allocation approach. Therefore, talent development is an important factor to ensure Swiss Re continues to attract employees with the expertise to assess attractive risk pools, especially in High Growth Markets, where local know-how is essential. Technological initiatives in smart analytics and cognitive computing will also have a direct impact in areas such as sales and underwriting analytics. Partnerships with external thought leaders in those fields, such as the recently announced partnership with IBM, are expected to further advance this part of the strategy.

IV. Emphasise differentiation

Financial strength, client relationships, and the company's status as a 'knowledge company' are key differentiators for Swiss Re. Since the beginning of 2015, more than 50% of Swiss Re's transactions in Property & Casualty Reinsurance were large deals, tailored specifically for individual clients and their specific needs.

Swiss Re's reputation is founded on its proprietary research such as the industry-leading sigma publications and its talent pool.

The company has around 300 employees working on research and development alone. Swiss Re's clients benefit from this leading-edge research tools and insights, for example, in more informed pricing of life and health risks. In addition, these activities may translate into a business impact for Swiss Re by helping the company make highly informed decisions about where to best allocate its risk capacity.

Ambitious financial targets from 2016 onwards

Swiss Re's two Group financial targets for 2016 and beyond aim to track profitability and economic growth over the cycle. In terms of profitability, the target is a return on equity (ROE) of or above 700 basis points above the risk-free rate, measured by 10-Year US government bonds. The growth target aims for an increase in Economic Net Worth (ENW) per share of 10% or more per annum. ENW is the company's internal measure to calculate the difference between the market value of assets and the market-consistent value of liabilities. It is the equivalent of the US GAAP measure of shareholders’ equity and Swiss Re's starting point in determining available solvency capital for the purposes of the Swiss Solvency Test.

In addition to the Group targets, the three Business Units have their own ROE targets over the cycle. Property and Casualty Reinsurance will target 10%–15% ROE and Life and Health Reinsurance 10%–12% ROE. Over the same period, Corporate Solutions will target 10%–15% ROE. The renamed Life Capital Business Unit aims at delivering 6%–8% ROE over the mid-term.

David Cole, Swiss Re Group Chief Financial Officer, says: "We have set ourselves ambitious targets for the future. Our capital position today is very strong, we have a flexible funding structure in place and we aim to maintain both. As a result, we believe our capital management priorities are attractive and they will remain unchanged. Maintaining a strong capital position and growing the regular dividend with long-term earnings are still our highest priorities. This is followed by the deployment of capital for business growth where it meets our profitability requirements. Finally we are committed to additional capital repatriation to shareholders, where appropriate."

Business Units bringing the framework to life

As announced in October 2015, Swiss Re will create the Swiss Re Life Capital Business Unit as of 1 January 2016. This unit will manage all closed and open life and health insurance books, including the existing Admin Re® business and, subject to regulatory approval expected in early 2016, the newly acquired Guardian Financial Services business in the UK. Combined, this Business Unit will manage 4,5 million life policies.

In addition to its extensive closed book life business, Life Capital aims to broaden Swiss Re's access to open book primary life and health business, for example by partnering with distribution partners such as primary insurers to offer new consumer products.

Swiss Re's Corporate Solutions Business Unit aims to continue its successful transformation into a leading player in the commercial insurance space. The Unit will continue to allocate capital to a diversified global portfolio of commercial risks in Credit and Surety, Casualty, Property and Special Lines. It aims to develop more products and services, especially in claims and risk engineering, as well as integrating the management of co-insurance panels as a primary lead.

The Reinsurance Business Unit aims to continue to outperform through both its P&C Re and L&H Re segments. Both segments will continue with their proven approach of portfolio steering. The Unit will target a broader and more diversified client base, especially among regional and national insurers, in casualty and health business, and in High Growth Markets.

Michel M. Liès, Swiss Re Group Chief Executive Officer, says: "The fundamentals that have driven Swiss Re's sustainable value creation in the past will remain valid going forward. Today is not a revolution, but an evolution and it builds on our existing successful strategy. We've looked extensively at our opportunities and challenges and we believe our strategic framework equips us very well to address changes with greater agility and selectively capture opportunities for profitable growth. As a result of this work, we've also reviewed what we stand for and updated our company vision. My colleagues and I are proud to work at Swiss Re with the aim of making the world more resilient."

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.