Results also showed:

• The number of members of long-term disability income policies increased by 2.2%.

• The number of members of lump sum death-in service policies increased by 4.7%.

• The number of members of dependants' death in service policies fell by 29.7%

• The number of members of critical illness policies increased by 4.8%.

Total market premiums by product line at the end of 2018 were:

• Long-term disability income premiums: £761,125,005, up 5.1%.

• Lump sum death-in-service premiums: £1,324,584,331, up 8.7%

• Dependants' death-in-service premiums £139,550,608, down 17.1%

• Critical illness premiums; £112,952,864, up 10.8%

"Overall, the results are solid," said Ron Wheatcroft, Technical Manager and author of the Report.

"Respondents to the market survey among providers and intermediaries referred to the very uncertain business environment in which many of their clients were operating. This has seen a number of decisions deferred and a reluctance to take on new commitments until the business environment becomes clearer."

Death in service benefits

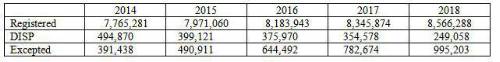

Once again, the market reported strong growth in the number of members of Excepted Group Life Policies (EGLP). In 2014, 391,438 people were EGLP members and between 2017 and 2018, the number of members increased by 27.2% to 995,203 people.

The number of in-force EGLPs increased by 21.8% from 7,130 to 8,686.

Meanwhile, the number of Dependants' Death-In-Service Pension (DISP) policies fell by 10.6%.

Although registered death-in-service policies still provide lump sum death benefit cover for most employees, EGLPs have now become an established way of providing death benefit cover through workplace arrangements.

Ron Wheatcroft commented: "Employer-sponsored death-in-service benefits have a vital role to play in protecting families against the financial consequences of an early death. Two trends are apparent this year.

Firstly, the decline in Dependants Death-In Service Pensions. While this business line has been in decline for many years, 2018 saw that decline accelerate as larger policies closed and were replaced by lump sum death benefits. While the number of members fell by 29.7%, the number of policies fell by 10.6%.

2018 also saw further growth in EGLPs as the market seeks alternatives to DISP arrangements and to pension-related death benefits. This reinforces the need to continue working with Government to obtain an exemption for such arrangements from periodic, entry and exit charges on the discretionary trusts holding such policies.

We estimate the annual cost of compliance for EGLPs alone to be £2.1m with further costs of a similar magnitude for legal advice. Yet, the revenue generated is tiny and no more than £1m per annum. As the market continues to grow, the disparity between costs and revenue increases.

In responding to HMRC's consultation on the taxation of trusts earlier this year, we reiterated our recommendation for an exemption, suggesting this be granted for all discretionary trusts where the asset is one or more life policies which can only pay out on death or disability. This would remove a burden from employers using EGLPs who are simply trying to do the right thing for their workforce by arranging life cover to protect their families and dependants and where the potential tax charge is both random and arbitrary."

|