-

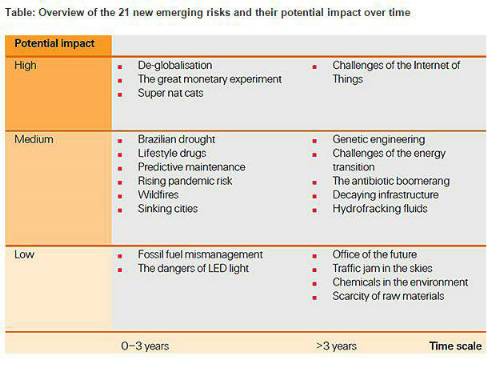

SONAR report looks at 21 emerging risk themes, their potential impact and cascading effects across the industry

-

The four emerging risks with the highest potential impact are de-globalisation, super natural catastrophes, the "great monetary experiment" and the challenge of the "Internet of Things"

-

Key drivers of the changing risk landscape are new economic, technological, socio-political and environmental developments as well as growing interdependencies

De-globalisation and political conflict, large natural catastrophes, financial repression and the challenge posed by the "Internet of Things" are some of the risks identified in this year's Swiss Re's "New emerging risk insights" report published today. The publication is based on the SONAR process, a crowdsourcing tool drawing on Swiss Re's internal risk management expertise to identify and evaluate new threats.

Emerging risks are newly developing or changing risks which are difficult to quantify and whose potential business impact is not yet sufficiently taken into account.

Patrick Raaflaub, Swiss Re's Group Chief Risk Officer, says:

"In a future in which change is the only constant, foresight information is crucial to prepare for tomorrow's challenges. This report seeks to provide an early indication of what might lurk beyond the horizon. While many of the topics presented might never materialize into significant risks, some definitely will. The earlier we start adapting to these changes, the better prepared we will be."

The report focuses on a wide variety of risks, relevant to life and non-life insurance areas. Highlights from this third edition include scarcity of raw materials, increased traffic in the skies, decaying critical infrastructure, and the use of self-tracking tools. Pandemic risks, the proliferation of vertical cities and the dangers of LED light are also among the key highlights.

The topics presented may not only bring additional downside risk exposure, but could also give rise to new opportunities. The insurance industry could and should expand its role of mitigating others' risks and enabling society to advance.

To download the full SONAR report please click on the document below

|