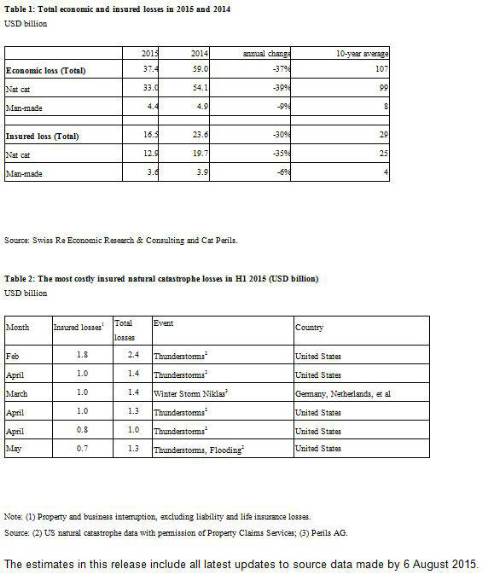

• Total economic losses from disaster events reached USD 37 billion in H1 2015

• Insured losses from disaster events were USD 16.5 billion in H1 2015

• Natural catastrophe-related insurance claims were USD 12.9 billion in the first six months of the year

• 18 000 lives were lost as a result of natural catastrophes and man-made disasters in H1 2015

Natural catastrophes caused total economic losses of USD 33 billion in the first half of the year, well below the USD 54 billion in H1 2014 and also the average first-half year loss over the previous 10 years (USD 99 billion). Of the overall insured losses, USD 12.9 billion came from natural disasters, down from nearly USD 20 billion in H1 2014 and again below the average first-half year loss of the previous 10 years (USD 25 billion). The costliest natural catastrophes for the insurance industry resulted from severe winter weather and thunderstorms in the US and Europe. In February, a winter storm in the northeastern US caused insurance losses of USD 1.8 billion, the highest loss of any event so far this year. Man-made disasters, meanwhile, triggered an additional USD 3.6 billion in overall insurance losses in H1 2015.

Earthquakes and soaring temperatures claim thousands of lives

Disaster events claimed many lives in the first six months of 2015. In all, around 18 000 people lost their lives. There were more than 9 000 fatalities in the earthquakes that struck Nepal in close succession in April and May, the largest loss of life due to any natural catastrophes so far this year. The quakes also left many people homeless. The economic losses in Nepal are estimated to be more than USD 5 billion. Of those, only around USD 160 million were insured losses. The insured loss estimate for the Nepal earthquakes is subject to change.

"The tragic events in Nepal are a reminder of the utility of insurance," says Kurt Karl, Chief Economist at Swiss Re. "Insurance cover does not lessen the emotional trauma that natural catastrophes inflict, but it can help people better manage the financial fallout from disasters so they can start to rebuild their lives".

In the same region, India and Pakistan were hit by a severe heat wave in May and June. Temperatures soared to 48°C, the highest recorded since 1995. It is estimated that more than 2 500 people died in India and 1 500 in Pakistan as a result of the extreme heat.

Another factor in the high number of victims of disaster events in the first half of this year is the number of migrants who have died attempting to reach Europe from conflict zones in northern Africa, often in unseaworthy vessels. In search of a better life, sadly these people have instead lost their lives as the boats capsized while carrying them across the Mediterranean.

Figure 1: Catastrophe-related losses (USD billion)

Note: insured losses + uninsured losses= total economic losses

Source: Swiss Re Economic Research & Consulting and Cat Perils.

|