|

|

Are the workplace benefits UK employees are LEAST interested in. Traditional workplace benefits like holiday allowance and pensions have trumped quirkier ‘benefits’ like being allowed to take your dog into the office, in a survey by Aviva. |

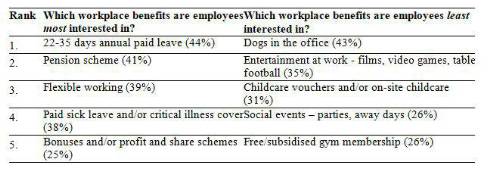

Out of a wide range of workplace benefits, 43% of UK employees said they were least interested in being allowed to take their dog into the workplace. More than a third of workers (34%) also said they weren’t interested in office entertainment like table football and video games. And more than 1 in 4 people (26%) even said workplace socials like summer and Christmas parties were among the benefits they were least interested in. Traditional workplace benefits came out on top in the survey, as 43% of people said they were most interested in paid holiday, 41% opted for their pension with 39% choosing flexible working as the benefit they are most keen on. Table 1: Which workplace benefits are employees most and least interested in?

Salary vs Benefits

For most people, pay will always be the ultimate benefit, and Aviva’s research proved that to be the case as 85% of workers said they would choose a salary increase over an improvement in their workplace benefits.

However, employers had a slightly different view with more than a third (38%) saying they would prefer to improve their benefits package for employees over increasing salaries. Colin Williams, Managing Director of Workplace Benefits at Aviva, said: “Workplace benefits have really come under the spotlight in recent years as employers and employees realise that while salary is important, there’s more that can be offered. “But while we hear of companies across the world experimenting with a range of benefits, some more unusual than others, it’s encouraging to see that employees still value the more traditional benefits. “Offering holiday, a decent pension and access to flexible working are clearly important to employees. These types of benefits can help create the foundations of a resilient workforce and a resilient business.”

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.