New Bank of England figures show hundreds of thousands of borrowers have taken out mortgages that stretch beyond the current state pension age in the last three years, with 42% of new mortgages in the final quarter of 2023 having an end date in retirement.* While 35 and even 40 year mortgages might sometimes be necessary to get on the housing ladder, analysis from Standard Life, part of Phoenix Group highlights the potential retirement benefit of paying your mortgage off as early as your circumstances allow.

Not only will paying off your mortgage a few years clear of retirement mean you won’t need to factor housing costs into your retirement planning, but money that used to go towards your mortgage could instead be used to increase your pension contributions and boost your retirement pot.

Standard Life’s analysis finds that those who begin working on a salary of £25,000 per year and pay the standard monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could build up a total retirement fund of £461,000 by the age of 66, not taking inflation into account. However, topping up contributions by 4% for ten years from the age of 55, the age at which a 25-year mortgage term taken out at the age of the 30 would be paid off, could result in a total pot of £513,000 – £52,000 more than if no tops up were made.

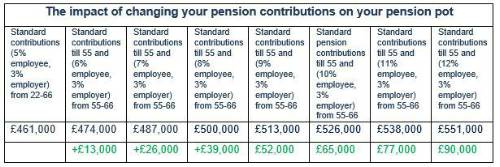

Adjusting the monthly contribution further will have a greater impact on the eventual retirement pot, and generally increasing contributions by 1% from aged 55 until retirement at age 66 could lead to £13,000 extra in your pension pot:

*if beginning working with a salary of £25,000 per year and paying monthly contributions into a workplace pension at the age of 22, assuming 3.5% salary growth per year, 5% a year investment growth and a 0.75% annual charge.

Mike Ambery, Retirement Savings Director at Standard Life said: “The Bank of England’s figures show a steep rise in long-term borrowing over the last couple of years, with younger homeowners in particular now more likely to extend their mortgage term. Interest rates have rocketed since the middle of last year and so it’s understandable that people are looking for longer mortgage terms to ease the monthly strain. It won’t be possible, or even sensible, for everyone to stick to a shorter mortgage term, however it’s worth considering the potential retirement impact of any decision. There are obvious benefits to being mortgage free in retirement itself, but additionally having the option to swap mortgage payments for pension contributions in those valuable years leading up to retirement can have a significantly positive impact on your pot, and as a result on your standard of living in retirement.”

“Having a think about what you’d like when you do retire is an important first step to inform your financial planning, and helps to visualise decisions like these. The Retirement Living Standards tool from the Pensions and Lifetime Savings Association can help, which shows what life in retirement looks like at three different levels - Minimum, Moderate and Comfortable. As well as everyday costs, the tool factors in what’s needed for extras- gifts, holidays and large purchases etc., as well as the one-off expenses that come up through life.”

|