In July 2015 the Chancellor announced a hike from six per cent to 9.5% to take effect from 1 November. Now senior Westminster sources have indicated that the Chancellor may slip another three per cent IPT increase under the radar in the Budget next week.

This means that if the rate increases to 12.5% the tax would have increased by 108% in six months.

If the Chancellor makes such a move the AA has vowed to clearly show all its millions of members and customers on their invoices just how much tax the Government is squeezing out of them on their insurance and breakdown cover.

Insurance Premium Tax already hits millions of people doing the right thing by taking out car insurance but in addition it is a tax on breakdown cover and home insurance.

IPT affects at least 50m car, home, pet and private medical insurance policies.

The last increase added an extra £100 to the annual cost of insurance for many households.

Edmund King OBE, AA president, said: “If the Chancellor does this it will be the only tax to have doubled in half a year. It would be a double-whammy con on drivers as it hits car insurance and breakdown cover. Treasury Minister Harriett Baldwin MP told us in a letter ‘IPT is not a tax on consumers but on insurance companies’ which is like saying ‘fuel duty is not a tax on drivers but on petrol stations’. This is disingenuous because insurance companies are not charities.

“It’s ridiculous that the insurance industry is singled out in this way,” said Mr King.

“If the Chancellor decides to hit drivers again we will do all in our power to show our members and customers exactly how much the Government is taking from them. Drivers are not wallets on wheels but appear to be treated that way by the Treasury. Car insurance is not a luxury but a legal necessity so should not be taxed like a luxury.”

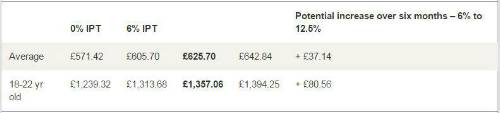

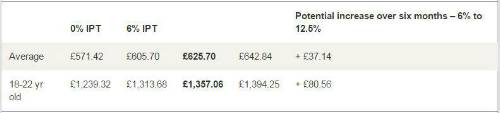

An IPT rise to 12.5% will mean £37 added to the average car insurance premium and over £80 for young drivers.

Figures based on latest AA British Insurance Premium Index Shoparound figures using quotes from both direct, broker and price comparison site sources. Current IPT is 9.5%, increased from 6% from 1 November 2015.

Figures based on latest AA British Insurance Premium Index Shoparound figures using quotes from both direct, broker and price comparison site sources. Current IPT is 9.5%, increased from 6% from 1 November 2015.

IPT Fact File

-

If this increase is introduced sooner rather than later, it will mean some drivers will be whacked twice with the tax within a year.

-

There is evidence that the number of uninsured drivers has increased since the last IPT hike as the AA warned.

-

Another increase will inevitably lead to more drivers attempting to drive without cover; more people choosing not to bother to renew their home insurance.

-

The tax comes at a time when car premiums are rising sharply thanks to continued rises in the cost of personal injury.

-

The most vulnerable drivers will be hit – i.e. those on low incomes; young drivers who bear by far the highest cost for their insurance; and older drivers as premiums rise in older age.

-

This is a tax on individuals not companies.

-

The increase in IPT has already cost insurers millions.

-

Last year average car insurance premiums rose more than 20% including the previous IPT increase. Another IPT increase will lead to further record rises in the cost of cover.

In an AA-Populus poll in July 2015, 89% of almost 30,000 respondents thought the increase to 9% was unjustified while 87% considered an increase in IPT would encourage more uninsured driving

|