This headline grabbing tax cut for many higher earners (although not in Scotland*) would however come with a pension sting in the tail. This is because anyone with earnings, after deducting pension contributions, of between £50k and £80k will lose higher rate pension tax relief, receiving basic rate relief instead. This mean the after tax cost to them will increase. The risk is that if this tempts them to scale back contributions to keep the cost unchanged, they face a 25% drop in their pension pot when they retire.

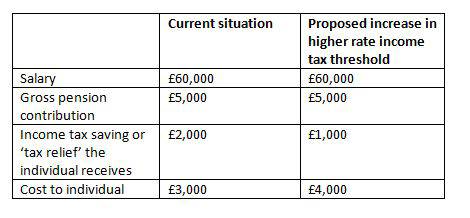

Today, the cost to an individual earning £60,000 and paying higher rate income tax of saving £5,000 a year into their pension is £3,000. This is because the Government pays a top up of £2,000 in the form of tax relief at the individual’s highest ‘marginal’ rate of income tax of 40%. But if the individual becomes a basic rate taxpayer, the cost of saving £5,000 into their pension would go up to £4,000 because the Government’s top-up would fall to £1000, based on basic rate income tax of 20%.

See notes below for details on the mechanisms around how pension tax relief is applied under the two alternative ‘relief at source’ and ‘net pay’ methods.

Steven Cameron, Pensions Director at Aegon said: “Increasing the higher rate income tax threshold from £50,000 to £80,000 will mean individuals earning over £50k will no longer pay 40% tax on that band of earnings. This will no doubt be very welcome and for those earning £80,000, could save them £6,000 a year in income tax. However, it also means those same individuals paying into pensions will no longer qualify for the higher rate tax relief which currently means a £5,000 pension contribution costs them only £3,000 after allowing for income tax savings. If these proposals are implemented, building up the same pot at retirement will cost them £4,000 after tax savings, or an extra £1,000 a year.

“While some may be tempted to keep the cost to them at £3,000, this will severely impact their ultimate retirement pot. It would mean the amount going in after adding on Government tax relief would be £3,750, a quarter less than the previous £5,000. This also means the pension fund built up from future contributions and the income it could pay will be a quarter less.

“If Boris does implement the increase in the higher rate tax threshold, the overall impact will still be an increase in after tax pay. While those contributing to pensions will see less of an increase, we hope this will be recognised as a price worth paying to keep retirement plans on course.”

Notes on the different ways pensions tax relief works

There are two different ways in which individuals can receive tax relief. This depends on the scheme they are in and the individual can’t change this without changing pension scheme. While the mechanisms are different, the overall result in terms of the ‘cost’ to the individual is the same.

Relief at Source

Let’s assume an individual earning £60,000 wants £5,000 to go into their pension. To do this, they currently pay £4,000 to their pension provider. The provider collects tax relief at 20% on the individual’s behalf which adds up to £1,000. This is added to the £4,000, meaning £5,000 is invested in the pension. The individual is however entitled to higher rate tax relief at 40% and can reclaim the extra over the basic rate through their tax return. The extra tax relief adds up to £1,000 which the individual gets back meaning the actual cost to them of having £5,000 paid into their pension is £3,000.

If the higher rate tax threshold is increased to £80,000, the individual’s marginal rate of income tax is 20%. Their £4,000 is still made up to £5,000 by their provider but the individual is now a basic rate taxpayer and can’t claim the extra £1,000 through their tax return. So the £5,000 contribution now costs them £4,000.

Net Pay

Again, let’s assume the individual earning £60,000 wants £5,000 to go into their pension. This is deducted by their employer from their salary before income tax is calculated. At the moment, it reduces their tax by 40% of £5,000, so £2,000. As above, after allowing for tax ‘savings’, the £5,000 contribution costs them £3,000.

If the higher rate tax threshold is increased to £80,000, the individual will be paying 20% income tax on all of their taxable earnings. So their tax will be reduced by 20% of £5,000, or £1,000. This means their pension contribution now results in less tax saving - £1,000 less. As above, the £5,000 contribution would now cost them £4,000.

* Differences in Scotland

The Scottish Government has ‘devolved powers’ to set its own income tax thresholds. When the UK Government previously increased the higher rate threshold to £50,000, the Scottish Government froze it for Scottish taxpayers at £43,430. Scottish taxpayers also pay different rates of income tax.

|