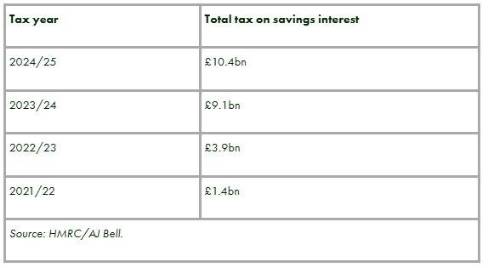

Laura Suter, director of personal finance at AJ Bell, comments on the latest figures on the government’s income tax take: “The amount the nation is paying in tax on their savings has increased ten-fold in the past four years, and this year it’s expected the nation will hand over more than £10 billion of their savings interest in tax. The latest figures show that the Government is predicted to land £10.4 billion in tax on savings interest in the current tax year – compared to the £1.4 billion it took in 2021/22.

“The estimates for last year have also been significantly revised up. It was expected that we’d collectively pay £6.6 billion in tax on savings interest in 2023/24, but the actual tax take for that year rose to £9.1 billion – almost 40% more than expected. If we see a similar increase between the predicted and actual tax take for this year it could mean the nation paying £14 billion in tax on their savings.

“This highlights that the Government is a big winner from rising savings rates, as while savers have been enjoying higher rates the taxman is dipping its hand into their back pocket and nabbing a chunk of the spoils.

“Part of the increase in the nation’s savings tax bill is down to people not using ISAs to protect their cash from tax during a period of rising interest rates. It means that while they have been benefitting from higher savings rates, they have been breaching their tax-free Personal Savings Allowance and paying tax on some of the interest.

“However, a huge part of this rise in tax bills is also that the frozen tax bands mean more people are being pushed into higher tax bands, which means they see their Personal Savings Allowance cut in half, or lost altogether if they find themselves in the additional rate tax bracket. In some cases the interest people receive is itself pushing them into the higher tax band – meaning they pay the tax at a higher rate and on more of their money.

“This is highlighted in the amount of tax paid by additional rate taxpayers. The threshold for the 45% tax rate was lowered from £150,000 to £125,150 last year. While basic-rate taxpayers get £1,000 of savings interest tax free and higher-rate taxpayers get £500, additional rate taxpayers get taxed on all their savings interest at 45%. In the current year the savings tax paid by additional rate taxpayers is due to rise to £8.3bn – astonishingly that is not far off the entire tax take on savings from all taxpayers last year. But no one is spared from the tax raid, as basic-rate and higher-rate taxpayers will also be paying more tax on their savings.

“Because of the way savings tax is calculated many won’t be aware that they even owe tax on their savings until a brown letter lands on their doormat. Those filling out a self-assessment tax return declare any savings interest and subsequent tax due. But for those taxed under PAYE HMRC receives information from banks and building societies on the savings interest paid to each individual, from which they then calculate any tax due. It means many will find they are repaying the tax through their payslip each month, often before they’ve realised they owe any money to the taxman.

“After the introduction of the Personal Savings Allowance many savers shunned ISAs, but we’re now seeing people flock back to ISA accounts to save the taxman grabbing more of their money. Pensions can also be handy in reducing people’s tax bills too. If someone has just moved into the next tax bracket, they can make pension contributions to bring them under the tax band, meaning they benefit from both a higher Personal Savings Allowance and a lower tax rate.”

Dividend tax

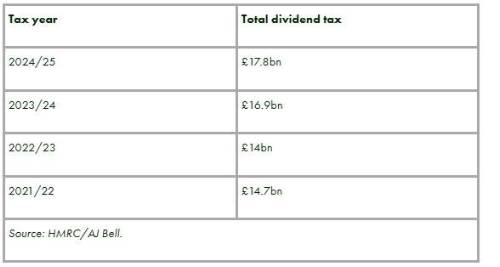

“The impact of the cuts to the tax-free dividend allowance is really being felt by the nation, who are expected to collectively pay almost £18 billion in dividend tax this year – an increase of £1 billion compared to last year.

“The Government has launched a triple assault on investors and company directors recently. The move to cut the tax-free dividend allowance from £2,000 down to £500 over the past couple of tax years means more people are paying dividend tax. But alongside this the freeze on income tax bands means that more people are being pushed into the next tax band, and so paying a higher rate of dividend tax. The third part of this is that the Government increased dividend tax rates, meaning these taxpayers are handing over more in tax. All this means that the Government is expected to take £3.1 billion more in dividend tax this year when compared to the 2021/22 tax year.

“However, the total tax take for last year has actually been revised down. The nation was expected to pay £17.6 billion in dividend tax but the revised figure shows £16.9 billion was actually paid. Likewise for the 2022/23 tax year it was estimated that £15.8 billion would be paid in tax on dividends, but this actually came in at just over £14 billion.

“Lots of taxpayers have been organising their money to be more tax efficient, with investors moving their money into ISAs to protect it from dividend tax. We saw a surge in Bed and ISA transactions towards the end of the tax year in April and we expect that to continue this year, as more people shelter their money in tax-efficient accounts. On top of that more people will be transferring assets to a lower-tax-paying spouse or using pension contributions to drop to a lower income tax band.”

|