The rise of the ‘lazy job’, in which people do the very minimum required at work, often with limited expectations of securing career progression, has become a theme of the post-pandemic years, following the ‘quiet quitting’ trend. Social posts on the theme have thousands or even hundreds of thousands of views and it’s often associated with Generation Z and Millennial workers in white-collar jobs, however the real prevalence of this approach to working life in any group is far from clear.

There are many reasons why people might favour a more relaxed approach to their career, including prioritising personal wellbeing and work-life balance. However, new research from Standard Life, part of Phoenix Group, highlights the potential retirement consequence of earning less for longer.

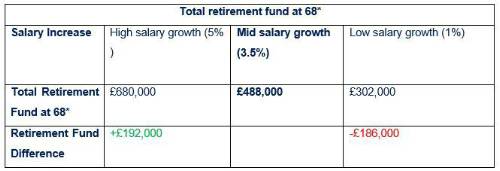

Standard Life found that someone who started working with a salary of £25,000 per year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22 could have a total retirement fund of £488,000 by the age of 68 if their salary increased by 3.5% a year, illustrating traditional career progression. However, if they chose to reject the career ladder and their pay rose by just 1% a year, this could fall to £302,000, £186,000 less than if they’d seen a consistent 3.5% rise. On the other hand, if they embraced career development and received a 5% pay rise each year, they could have a pot of £680,000 at retirement. The figures are not adjusted for inflation.

*if beginning working with a salary of £25,000 per year and paying 3% employer and 5% employee monthly contributions into a workplace pension at the age of 22, assuming 5% investment growth and a 1% investment charge, no minimums applied

Gail Izat, Managing Director for Workplace at Standard Life, part of Phoenix Group said: “‘Lazy jobs’ and ‘bare minimum Mondays’ seem to have replaced ‘quiet quitting’ as popular ways to describe slowing the pace down at work, and they’ve come to be associated with Gen Z and younger Millennials. In reality, stereotyping different generations is unhelpful and people are likely to have similar goals for their financial security and overall wellbeing. While there’s some evidence that younger generations place a greater emphasis on wellness at work1, this isn’t incompatible with career progression. What’s clear from the analysis is that over time, low salary growth could have significant retirement consequences and this should be considered as part of people’s decision making.

“Stimulating awareness of this is vital. Employers and providers can help people to consider long-term saving as part of their overall wellbeing through relevant, targeted communications and giving people the option of seeing all their finances in one place through tools like open finance. Directing people to online pension calculators and the Pensions and Lifetime Savings Association (PLSA’s) Retirement Living Standards can help people to form an idea of the standard of living they’d like in retirement, and whether they’re on track to achieve it, even early in their career.”

|