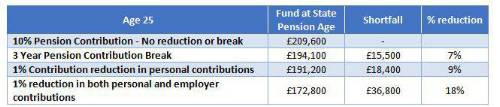

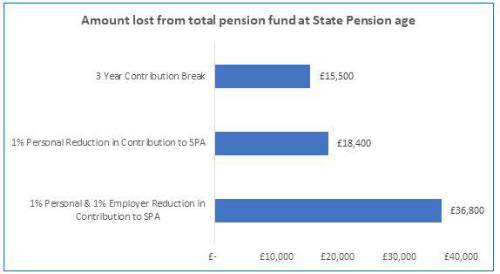

Aegon analysis shows even a 1% reduction in personal contribution rate or 3-year ‘pension pause’ could have a significant long-term impact on retirement income. For a 25-year-old employee on average earnings, paying 6% in personal contributions and receiving 4% from their employer, making a total pension contribution of 10%, stopping contributions to their pension entirely but starting up again after three years at the previous contribution level, could mean losing out on £15,500 at state pension age (SPA). This assumes, as is highly likely, their employer also stops contributions. Eligible employees who opt out of a workplace pension scheme will be re-enrolled at their employer’s re-enrolment date, up to three years after opting out.

Rather than ‘pause’ pension contributions for a period, if this individual decides to reduce personal contributions by just 1% until SPA, this could mean losing out on £18,400 at SPA. The 1% decrease is equivalent to an initial reduction in monthly pension contributions of £14 from take home pay.

Some employers ‘match’ employee contributions which could mean reducing personal contributions by 1% leads to the employer also reducing by 1% which would double the loss in retirement funds to £36,800.

Table 1 - Aegon Analysis, December 2020. Individual is 25 years old with a pension pot of £10k. The decrease in contribution and three-year break is taken from 2020. Starting Salary, £27,000 increases 3% annually. Investment growth, 4.25%

Table 2 - Aegon Analysis, December 2020. The total fund value without a break or reduction in contributions is calculated at £209,600 at state pension age with a total pension contribution of 10%. Individual is 25 years old with a pension pot of £10k. The decrease in contribution and three-year break is taken from 2020. Starting Salary, £27,000 increases 3% annually. Investment growth, 4.25%

Steven Cameron, Pensions Director at Aegon, comments: For many, the coronavirus pandemic has placed an extreme strain on finances and individuals may look to areas that can ease the pressure. However, those looking to cut back on their pension savings levels should carefully consider the long-term effects on their retirement pot before making any decisions.

“While there may be an immediate boost to take home pay, Aegon analysis shows an employee in their mid-20s on average earnings could lose out on around £18,400 at state pension age if they decrease their contributions by just 1%, or a 9% fall in retirement income. But the saving in take home pay would only amount to £14 after tax relief. The shortfall could be even greater if they are in a scheme where their employer ‘matches’ their contributions. If their employer also reduces their contributions by 1%, the shortfall would double to £36,800.

“The power of compound investment growth means it’s the pension contributions paid in the early years that have longest to grow and make the biggest difference in ultimate retirement income. But for those closer to retirement, a small reduction in contributions can still have a big impact.

“Some employees might consider ‘opting out’ of their pension scheme for a period to ease financial pressures. However, it is important to understand the implications of this as they will not only miss out on personal contributions, but also lose valuable employer contributions which help to boost retirement savings.”

|