With slowly improving economic conditions forecast for 2024, following two years of high inflation alongside rapidly rising interest rates, it’s personal finance issues that are high on the agenda of many Brits. New research from Standard Life’s Retirement Voice report reveals that more people – particularly younger adults – are now beginning to think about their financial future and are turning their attention to their retirement finances.

More than one in seven (16%) said that rising inflation has prompted them to take more of an interest in how much money they’ll need to live on in retirement, while 11% said increasing interest rates have encouraged them to think about this too.

Younger generations in particular have now started thinking about their future finances, 21% because of inflation and 15% because of interest rates. This is promising, as Standard Life analysis shows that engaging with your financial future from an early age and giving yourself a head start with pension contributions could pay off later.

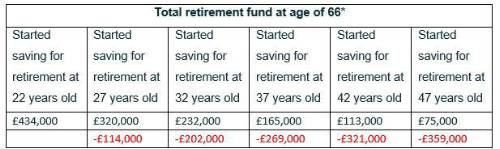

The analysis finds that those who begin working on a salary of £25,000 per year and pay the standard monthly auto-enrolment contributions (3% employee, 5% employer) from the age of 22, could have a total retirement fund of £434,000 by the age of 66, not adjusted for inflation. However, waiting just five years to age 27 to start contributing could result in a total pot of £320,000 – £114,000 less. Waiting even longer could have an even bigger impact on a retirement pot:

*if beginning working with a salary of £25,000 per year and paying 5% employee and 3% employee monthly contributions into a workplace pension at the age of 22 and assuming 3.5% salary growth per year, a 1% annual investment cost and 5% investment growth per year. No Earnings Limits.

Gail Izat, Managing Director for Workplace at Standard Life, part of Phoenix Group commented: “It’s been a tough couple of years for people of all ages in the UK, but younger adults have seen some of the worst impacts of rapidly rising prices and interest rates as essentials are likely to form a higher percentage of their monthly spend and their living situations are often more precarious. The fact this seems to have led younger generations to consider their long-term financial planning more is perhaps one positive to take from the situation, as it’s likely to improve their outcomes in retirement.

“Employers and providers have an opportunity to help their younger employees and scheme members continue this trajectory by providing relevant and targeted communications, engaging tools and a focus on financial education and wellbeing, as well as taking a holistic approach to people’s finances – perhaps through use of open finance or helping them with other pressing financial priorities such as buying their first home. The far future can be daunting, but showing how long-term saving is part of a larger whole can help people to visualise their finances in the round and lead to better future outcomes.”

|