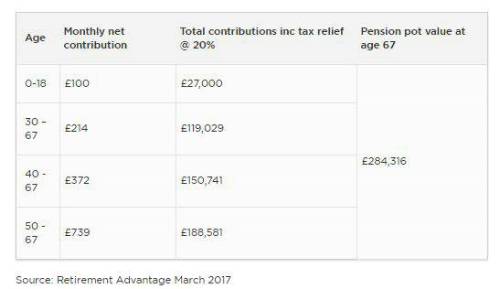

Investing £100 a month on behalf of a child from birth to age 18 could create a pension pot worth £284,316 when they reach age 671

In comparison, starting the savings habit at age 30 you would have to contribute £214 a month for the same benefit (and save £119,029)

At the age of 40, you would have to pay in £372 a month for the same amount for retirement (and save £150,741)

If £100 a month was saved on behalf of the child from birth to age 18 (£27,000 in contributions after grossing up for tax relief), and allowing for average investment growth of 4% net of charges, the pension pot could be worth £284,316 at age 67.

By contrast, if you started saving at the age of 30, to achieve the same pension pot of £284,316 would require a monthly contribution of £214 for 37 years (£119,029 in contributions). At the age of 40, you would need to pay £372 for 27 years (£150,741 in contributions).

Andrew Tully, pensions technical director at Retirement Advantage, said: ‘A pension could be one of the best gifts you can give children or grandchildren. It may seem daft to think about a pension when you’ve just started a family, but it could be the best financial start in life.

‘Not only do you hopefully create a savings habit early on, but the pension contributions are helped by the effects of compounding interest. Over time, you receive interest on the interest and this can be one of the most powerful forces in finance. Even if £100 a month seems a lot of money, smaller savings still creates the same effect over time.

‘Although successive governments have a habit of changing the pension rules and moving the goal posts, you shouldn’t ignore taking full advantage of both tax relief and compound interest when thinking about savings for children.’

The effect of compounding interest

Rules and tips

Parents and relatives can save on behalf of the child up to £2,880 a year into a pension, with the Government topping that up to £3,600 through tax relief

Minimum pension contributions typically accepted by pension plans are £20 a month

The child or ‘gifter’ does not need to be a tax payer for the contribution to attract a 20% top-up from the tax man

Early access isn’t allowed - the child must wait till they are 10 years away from their own state pension age before they can access the cash (currently age 55 but increasing to age 58 by 2028)

The child can continue to pay into the pension when they take ownership at age 18, or they can leave it to grow

At age 18, the child can decide to transfer the pension to another scheme or choose to leave it as a separate plan

The maximum contributions of £2,880 are below the annual gift allowance of £3,000 for inheritance tax purposes

|