The new ‘23’ plate arrives on 1 March, and with it comes one of the busiest times of the year for car insurance renewals.

With renewal reminders hitting doormats and flooding inboxes, new research from Forbes Advisor, the trusted financial guidance and price comparison website, can reveal that the point at which people buy their car insurance can have a big impact on premiums.

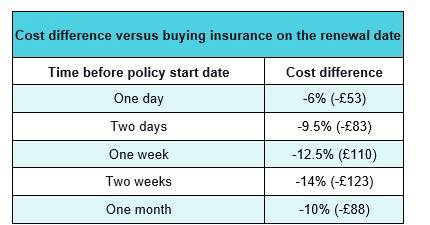

You can usually choose to buy your car insurance up to a month before it’s due, and generally speaking the sooner you take out your policy, the less you will pay. But Forbes Advisor’s research found that prices could vary significantly depending on how close to the cover start date quotes were obtained.

The sweet spot for savings could be two weeks before the policy renewal date, when costs were shown to be, on average, 14% cheaper. This amounts to a typical saving of £123 per year, based on an average annual car insurance cost of £877.

While the amount saved varied, one thing was universal - buying insurance ahead of time was always cheaper than waiting till the due date itself.

Source: Forbes Advisor

Kevin Pratt, car insurance spokesperson at Forbes Advisor, says: “There are a number of reasons why premiums can alter so significantly as you draw closer to your renewal date. One reason is necessity - after all, car insurance is a legal requirement, and motorists who leave it till the last minute to get their insurance are faced with an unforgiving deadline and are likely to stomach higher costs just to get the job done

“Another comes down to risk, or rather how likely insurers believe it is that they’ll need to pay a claim. Insurers use a wealth of data to make assumptions about their customers, so taking out cover in good time may indicate that you are organised and therefore more likely to look after your car and as a result be less prone to make a claim.”

“Despite the Financial Conduct Authority (FCA) introducing rules at the start of 2022 that ban insurers from quoting existing customers a higher price than they would a new customer, people can still save up to £334 by switching to a different insurer.

“This is because your existing insurer isn’t necessarily going to offer the best value year after year. There might, for example, be a change in your circumstances, such as claiming for an accident or reporting a motoring conviction. Each insurer will react differently and charge accordingly.

“Also, certain firms might start to favour older drivers, say, or those living in particular areas, so it is always worth running a comparison quote to make sure you’re getting the best deal.

“Shopping around for quotes takes a matter of minutes, so if your renewal is due soon it’s worth comparing prices from other insurers, and doing so well ahead of time.”

|