By Adrian Boulding, Pensions Strategy Director By Adrian Boulding, Pensions Strategy Director

Legal & General

So why are pensions so much the preserve of the larger employer, and what is being done about that?

In part it is the higher costs of running schemes for small employers, who lack the economies of scale. Although there have been some successful attempts to find these economies of scale through collective endeavour. Notably successful have been the Pensions Trust, offering final salary pensions to the third sector, and the Printing Industry Pension Scheme which has over £100m under management in money purchase pensions for small print employers.

But it is also a time factor. I remember from my days as a funding actuary, that when presenting the triennial review to the trustees of a small company scheme, they simply wanted to cut through the actuarial niceties in quick time, make a prompt decision on the next year’s contribution rate and get back to their real job of running a small business.

With strong cross party consensus, the politicians are changing this traditional bias by employer size. The pension reforms, which are staged over the period 2012 to 2016 will require employers of all sizes to have a pension scheme, and to automatically enrol their employees into it. This legislation was forged during the third term of the Labour Government, stemming from proposals by Lord Turner’s Pensions Commission.

Immediately on coming to power the current Coalition Government instigated an independent review of the reforms, with a very practical focus into making automatic enrolment work. The review team were strongly lobbied by various small employer groups to exempt the smallest employers from the reforms. Quite a head of steam built up around the number five, in line with the Stakeholder legislation a decade ago, exempting employers with fewer than five staff.

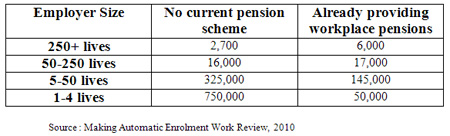

This was certainly a big call for the review, as there are 800,000 small employers in the UK with fewer than five staff. Included in this group are 192,000 single employer firms, some of which are genuine businesses, like a self employed plumber who has hired an assistant to carry his bags and learn the trade, some of whom are “accidental” employers, like families who have hired a nanny or domiciliary carer.

But the scale of this issue just underlined the importance of including all employers. To have excluded businesses with fewer than five staff would have denied automatic enrolment and the concomitant compulsory employer pension contributions to 11/2 million people. That was far too many to ignore.

Furthermore, exempting small employers would have created an impediment to business growth. Firms of four staff would be reluctant to take on a fifth employee, as they would then have to pay pensions for all five. The review calculated that, even allowing for some of the five opting out and for the noticeably below average wages that small employers tend to pay, a typical firm taking on a fifth employee would incur an annual pensions bill of over £1,500. At a time when Government are severely pruning back the public sector and looking to small private sector firms to grow and mop up the resulting pool of labour, such a disincentive to expand a small business would have costly macro-economic consequences.

If a Government is going to introduce legislation requiring all employers to provide workplace pensions, then it is important to ensure that all employers will be able to find a pension provider in the open market, without too much difficulty. Otherwise the Pension Regulator’s preferred approach of “contingent compliance” would come apart at the seams. The projected regulatory costs have been squeezed to a minimum on the brave assumption that the vast majority of employers will comply with the legislation because they recognise that providing a pension is the right thing for them to do and that their peers are pretty much all complying too. That assumption wouldn’t have a snowflake’s chance in hell if pension providers were hard for small employers to find!

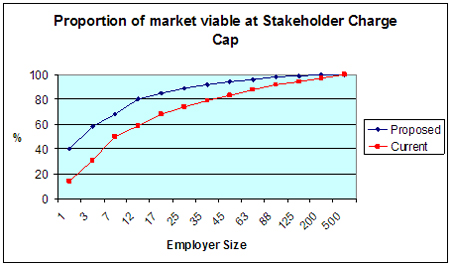

The Making Automatic Enrolment Work Reviewers were given access to a pricing and profitability model that DWP have built of the UK’s employer universe. It showed, by size of employer, how large a proportion of the employer universe would be commercially viable for private pension providers to service. In a market based economy you probably need to have at least 80% of the customer base viable in order to achieve 100% coverage. The least desireable 20% of customers should still be able to find a pension provider as some market players may take un-profitable business as a way of growing scale, some may have a model that specialises in sectors unattractive to mainstream players, and some market participants may be too unsophisticated in their underwriting to filter out the loss making plays.

The Reviewers were able to flex the pricing model to reflect the effect of the various other de-regulatory measures that the Review was proposing. The graph below shows how these measures dramatically extended the ability of private sector pension providers to reach into the employer market at all sizes of employer. But the key 80% threshold was still missed for employers of around fifteen staff or less, and at the pinch point of four or five employees around half of businesses would have had difficulty finding a pension provider to take them on.

Source : Making Automatic Enrolment Work Review 2010, showing how the Review’s de-regulatory proposals increased the reach of pension providers over the current legislation.

In order to fill the gap, and take the less commercially desireable employers in the top left hand corner, Government are building a new pension scheme with public money and an obligation to take any employer that applies to them. The Review concluded that NEST, the National Employment Saving Trust, was a vital cornerstone of the automatic enrolment reforms.

Such a major State intrusion into the pensions market is not without its hopes and concerns. Originally dubbed “Britsaver” in the Pensions Commission’s early days, NEST’s big hope from a pricing point of view is that it will garner a persistency bonus that ordinary pension schemes can’t. The logic is that its consumers will keep on coming back. In a typical career today an employee will have eleven different jobs, and I estimate that three of them will be with employers who have adopted NEST for their pension provision. That gives NEST a threefold persistency advantage over traditional single employer pension schemes.

But a concern of the pensions industry is also evident in the pricing graph above. Because NEST will be obliged to take the unprofitable business from the top left hand corner, it will also need to build a distribution capability to go out and seek the juicy fruit in the bottom right hand corner, in order to balance its books.

Woe betide any existing pension providers who under-estimate NEST as a potential competitor in what will be a fiercely fought over market as employers prepare for the 2012 pension reforms.

Adrian Boulding is Pensions Strategy Director at Legal & General and was a member of the independent Making Automatic Enrolment Work Review.

|

By Adrian Boulding, Pensions Strategy Director

By Adrian Boulding, Pensions Strategy Director