Revealing the “gender investment gap” in the UK, the research has taken a close look at the disparity in earnings between men and women across the country. With women’s salaries being over £13,000 less on average, the study has then examined the difference between what men and women could save if they invested 7.5% of their salary each year into stocks from 2023 until 2030.

London has the biggest gender investment savings gap with a £14,178 difference between the value of men’s and women’s investment pots by 2030

Due to men (£41,850) earning a higher average annual salary than women (£28,765) in the UK, the research found that men’s investment pots could be worth around £10,362 more than women’s if they follow a regular investment strategy up until 2030.

If men and women in London had started to annually invest 7.5% of their income at the start of 2023 in stocks, the research shows that there would be a difference of £14,178 in their investment savings pots by 2030, the biggest gap in the UK. Men would see their investment pot soar to around £44,470, while women would see their investment pot worth an average of £30,292.

Brighton & Hove has the second-largest gap in investment savings (£12,250) whilst Exeter has the third-largest gap in the UK, with a £11,979 difference between men’s and women’s average investment value by 2030.

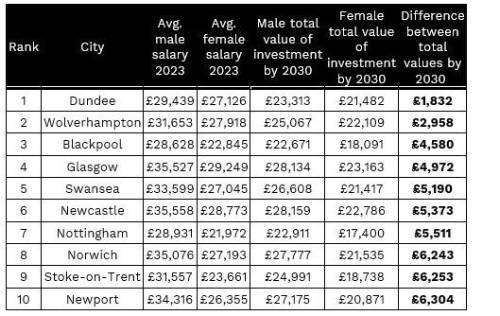

Dundee has the smallest gender investment gap, with female investors’ pots being worth £1,832 less than men’s by 2030

Dundee is the UK city with the smallest gender investment gap, due to the gender pay gap being significantly lower here. Men earn a salary of around £29,439 on average each year in the city, and women aren’t too far behind this, earning around £27,126.

If both men and women in Dundee invested 7.5% of these salaries into stocks until 2030, men would see their investment savings pots increase to around £23,313 in total, and women’s investments would be worth around £21,482. This leaves a gender investment earnings gap of just £1,832.

Wolverhampton follows behind with the second smallest gender investment savings gap, with a difference of £2,958. Meanwhile, Blackpool comes in third with women’s average investment pots averaging £4,580 less in value than men’s.

Shepherds Friendly’s Chief Finance Officer Derence Lee, comments: “How much you can afford to set aside for investing will depend on your financial circumstances, however, it’s interesting to see how the gender pay gap may be causing discrepancies when it comes to what female investors can earn.

“As a beginner in the world of investment, it’s natural to feel overwhelmed. To meet your financial goals, take the time to educate yourself on the different investment options available to you. Try to establish clear financial goals to give yourself a sense of direction and motivation. Plus, keep in mind that investments do involve risk and returns aren’t guaranteed.”

For more information on the gender investment gap, see the full results here:

|