January is ‘death month’; this week will see almost a third more deaths registered than average for the year

Cost of dying continues to rise much faster than the cost of living

The funeral bill for January could be more than £250m

This week (4-10 January 2020) will see 31% more deaths registered than is average for the year with 44 every second1. And that will create a funeral bill of £61million in a week, according to analysis from SunLife, author of the Cost of Dying report, released today.

The Cost of Dying report is the leading and longest running report into funeral costs and has been tracking funeral costs for 16 years. The latest report, released today, reveals that the average basic funeral now costs £4,417– a rise of 3.4% on last year, 23% over the past five, and a rise of 130% since SunLife started tracking funeral costs in 2004.

That means that in the month of January – which according to the ONS sees 27.4% more deaths registered than the rest of the year – the total funeral bill could be upwards of £250million, with a funeral bill of £61million just this week.

Families facing huge costs

Most of us (70%) think funeral costs are the responsibility if the deceased, however, according to The Cost of Dying, just 37% of people put aside sufficient funds to cover their funeral while 36% left nothing. This means more than £155million or 62% of January’s total bill will have to be paid by loved ones. Sadly, for one in eight (12%), paying for a loved ones’ funeral causes notable financial concerns:

22% were forced to borrow money from friends and family

10% had to take out a loan

25% put it on a credit card

15% had to sell belongings to cover the cost.

Direct cremations are cheaper, and costs are falling

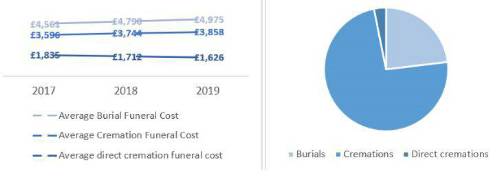

A direct cremation - where the body is taken away, cremated and the ashes returned to the family without a funeral service – is the cheapest type of funeral. And, while standard funeral costs have been rising by an average of 5.7% for the past 15 years, the cost of direct cremations are falling.

However, despite the fact that they are considerably cheaper than standard cremations, just 4% of funerals are direct cremations. But this is probably because most people don’t know what they are.

The Cost of Dying report found that 44% of people who had recently organised a funeral were not aware of direct cremations, but once they knew what they were, 19% said they would have considered it for the deceased and 42% said they would consider one for their own funeral.

Ian Atkinson, marketing director at SunLife said: “SunLife’s research shows that most of us think the deceased should pay for their own funeral, yet many of us don’t put aside enough money behind to cover the entire cost.

“In addition, the bereaved sometimes feel they need to spend a lot on the funeral, when actually that may not have been the deceased’s wishes. There are ways to cut the cost of a funeral – for instance, by having a direct cremation and a simple get together afterwards.”

Whatever type of funeral you want, Atkinson points out that it’s important to talk to loved ones about it, but most of us don’t; according to SunLife’s Cost of Dying report, less than half (42%) of those organising a funeral knew the deceased’s preference for a burial or cremation and just 38% knew if they wanted a religious or non-religious service.

Atkinson concluded: “We need to break the taboo surrounding death and start talking about it. By telling our loved ones what type of funeral we want, we can make sure no one spends more than they need to, and everyone gets the perfect send-off.”

|