People’s mid-twenties can be a fun time, as the independence of adulthood starts to replace skint student days and the freedom of setting up alone or with friends beckons. However, new research1 from Standard Life, part of Phoenix Group, finds first salaries might not stretch as far as young workers hope as the reality of paying for necessities like utilities and council tax kicks in. The number of people making regular ‘everyday’ payments rises significantly among those aged 25 to 34, compared to those aged 18 to 24, highlighting the additional financial demands of growing up.

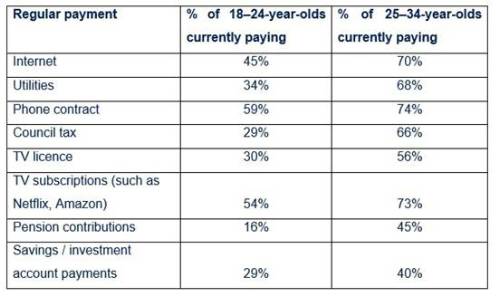

Standard Life’s Retirement Voice study shows that just a third (34%) of 18 to 24 year olds currently pay utility bills, but this doubles to 68% among 25 to 34 year olds. Similarly, 45% of 18- to 24-year-olds pay for their internet usage, rising to 70% of 25 to 34 year olds. The pattern follows across other regular payments too:

Regular payments ramp up in retirement

Once regular payments begin, they don’t tend to go away. Standard Life’s research also shows that these regular payments continue as people reach retirement age or stop working. Nine in ten 65- to 80-year-olds, either still in work or retired, pay internet (87%), utility (90%), council tax bills (91%) and TV licence (90%), as well as 82% paying for their phone contract.

Dean Butler, Managing Director for Customer at Standard Life, commented: “There’s a lot going for being in your mid-late twenties, when the freedom and excitement of living under your own steam tends to begin, however it’s also the time when the reality of paying regular bills hits. As such there’s a very sudden jump in the average number of people reporting regular payments when they are 25 to 34 years old, compared to the ages of 18 to 24. Not all these payments can be said to be ‘essential’, however the big hitters are, and for people in the early stages of their careers it can be a real challenge to stretch entry-level salaries to cover these recurring expenses let alone think about making contributions towards savings such as pensions and investment accounts. As a result, the financial pressure on younger households can be tough, and can come as a bit of a shock.

“As most of these costs will continue throughout your lifetime and into retirement, it’s important to get into a good habit of managing your regular payments. This can feel difficult when you’re first hit with an increase in bills, and especially now, when the cost of living is high. Taking time to budget accordingly, seeing whether you can reduce any regular costs by switching providers or finding a better deal, and setting goals for future can help tackle the financial strain.”

Dean Butler outlines tips for managing regular payments:

1. Create or review your budget – “It may seem obvious, but making a household budget can give you peace of mind about whether you’re able to afford your essential costs, and whether you have money left over for any non-essentials. If you already have a budget, it’s worth checking to see if it’s still working for you, especially as many costs have been rising over the last few months. When you take a closer look at your current and past spending habits, you might find ways to cut costs going forward – freeing up some money to put elsewhere. There are a number of budgeting apps that can help with this by analysing your spending and allowing you to categorise what you spend, making it easier to see where you can make savings.

2. Check where you can make savings – “It’s always worth seeing if you can cut costs by changing provider or shopping around to see if you can get a better deal on your phone contract or utilities bills, for example. Nowadays, switching providers is a relatively seamless process and it can save you substantial amounts. As you get older, you should check for any discounts or benefits you’re entitled to. For example, you can get a free TV Licence if you, as the licence holder, are 75 years or older and you, or your partner living at the same address, receive Pension Credit.

3. Set goals – and consider ways of saving – “If your budget allows, try to set some manageable savings goals for yourself. The clearer your goals, the easier it is to put a plan in place to achieve them. Even if you find that you don’t have the money to set aside right now, just taking the time to explore your options will help you better manage your finances. If you can save, first try to build up a ‘rainy day fund’ for those unexpected expenses that can tip monthly budgets over the edge, like appliance or car repairs.

4. Consider longer-term savings and retirement planning – “Remember that saving into a pension plan can be a good way to reach your goals. They offer tax relief on your payments, so putting money into one can cost less than you might otherwise think. If you have a workplace pension plan, your employer will normally pay into this – usually making a minimum payment of 3% of your earnings, while your personal minimum contribution is typically 5%, with some employers willing to pay in more. Some even match the employee payments up to a certain amount – meaning if you can put in more, they will too. It might be worth checking to see what’s possible, as this is a great way to give your pension savings a boost.

“It’s also beneficial to start contributing to your pensions from as early an age as possible, if your finances allow it. Our analysis2 finds that those who begin working on a salary of £25,000 per year and pay the standard monthly auto-enrolment contributions (3% employee, 5% employer) from the age of 22, would have a total retirement fund of £434,000 by the age of 66. However, waiting just five years to start contributing to a pension, beginning payments at the age of 27, would result in a total pot of £320,000– £114,000 less.”

|