People who expect to rent throughout their retirement could need an additional £391,000 in savings compared to those who have paid off their mortgage, according to new analysis from Standard Life, part of Phoenix Group.

Office for National Statistics (ONS) figures show the average monthly rent in the UK is currently £1,246, and the average annual rent increase since 2016 is 2.5%. The analysis projected these costs forward from state pension age to average life expectancy and found significant regional variances with the total sums required ranging from £660 for the North East and £2060 for London in year one. By the end of the 20-year period, the same cost will be £1060 for the North East and £3290 for London. In reality, year by year rental increases will vary subject to factors including inflation and interest rates, however these figures give an indication.

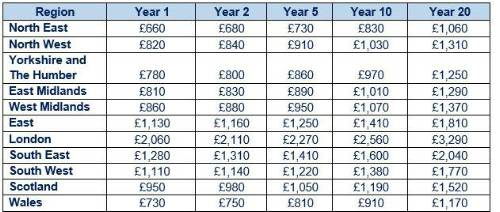

Average rental costs by region, projected for 20 years:

*figures project annual increase of 2.5%, and are not otherwise adjusted for inflation. Rounded to the nearest £10.

The Pensions and Lifetime Savings Association recommends that pensioner couples need a minimum of £22,400 a year in retirement to cover essential needs and some discretionary spending, but this excludes housing costs. This means renters could find that they require total savings of £839,000 per household over the course of 20 years in retirement - an 87% increase compared to those who are rent and mortgage-free, who would require a smaller amount of £448,000.

This analysis comes as the average cost of buying a UK property hit £375,000 in May and mortgage rates remain higher than we’re used to, stretching affordability for many home-buyers. While it’s difficult to predict how house prices will change in the future as we’re yet to see how demand and supply for UK housing will play out, it’s likely that buying property will remain a financial stretch for people.

Claire Altman, Managing Director of Individual Retirement at Standard Life, part of Phoenix Group, commented: “For many people, their home not only has emotional significance, but it is also something they may expect to rely on in retirement. However, if house prices continue to rise, people will increasingly need to think about how they will meet essential housing costs in retirement, with the Pensions Policy Institute predicting the proportion of households that will own their home in retirement could fall from 78 per cent to 63 per cent by 2041.

“For those who don’t eventually buy, these figures highlight the likely additional savings to be factored into budgeting, which is unlikely to be achieved through contributing the minimum amounts to a pension. This will have knock on consequences for how people manage their retirement income too, as people look to find ways to secure their fixed rental costs, which could be through annuitising in tranches, an inflation-linked annuity, or other means.

“An individual’s housing status is very important in retirement planning, but for many, consideration will need to be given to the trade-offs between saving for retirement and getting on the housing ladder. Whatever your housing position, it’s important to be thinking about how pensions and property work together as you plan for your retirement, and there’s a clear role for pension providers to play in offering tools and resources to help people access the property ladder at different stages in their journey to and through retirement, alongside their retirement savings.”

Catherine Foot, Director of Phoenix Insights, Phoenix Group’s longevity think tank comments: “Phoenix Insights research found less than a third of current renters expect to buy a house, leaving close to 11 million people needing to fund ongoing rental costs in retirement. Planning ahead for these costs will be crucial but this group typically face higher ongoing housing costs throughout their working lives as well as a lack of predictability of costs, which makes it harder for them to save. Supporting people to remain in good work is critical to enabling those facing housing costs in later life to continue to earn and save for as long as they want or need.”

|