By Richard Parkin, Head of Proposition for DC and Workplace Savings, Fidelity International

Since the last financial market downturn of 2007-09, there has been a clearly observable trend among UK DC pension plans to favour lower risk investment strategies. Against a background of sharply increased volatility, significant equity market declines and negative media stories about pensions, such a response from pension trustees and their advisers was not surprising.

The trend towards de-risking has been seen in declining allocations to equities and rising allocations to other asset classes, particularly bonds, but also commodities, property and private equity. The overall effect of this has been increased diversification within default investment options. Of course, reduced equity allocations tend to entail lower expected returns - pension trustees have understood this but their overriding preference has been to shift the focus away from the objective of maximising returns to looking more at how they control overall risk. The underlying driver of this change has been the effort to ensure a smoother and less bumpy investment journey for plan beneficiaries.

Understandably, the growing demand for less risky propositions has manifested itself in increased demand for multi-asset funds, which as well as being more diversified also have the added advantage of being able to shift dynamically between asset classes in response to varying market conditions. In addition, there has been renewed interest in active management at the underlying asset class level with a view to reducing downside risk and increasing the potential to recapture performance lost through diversification. Supporting increased demand for more diversified funds has been good evidence to show that such strategies did indeed perform comparatively well during the last downturn.

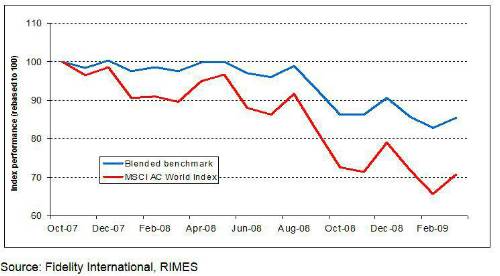

The chart below, which looks at the last major downturn period from October 2007 to March 2009, shows the significant outperformance of a more diversified blended benchmark (equities: 35%, commodities: 10%, property: 5%, bonds: 40%, cash: 10%) compared to a pure equity strategy represented by the MSCI AC World Index. During this period, the blended benchmark can be seen to outperform the pure equity strategy by a substantial 14.7 percentage points. Of course, good tactical asset allocation (around the broad parameters of the blended benchmark) combined with good security selection can further enhance returns. In the case of Fidelity’s Multi Asset Strategic Fund for example, this amounted to an additional 5.2 percentage points of outperformance versus the MSCI World Index over the same period.

How more diversification offered more downside protection in the 2007-09 downturn

Issues surrounding risk and risk control have also been gaining prominence in the design of lifestyle investment strategies which have now become the mainstay of UK DC investing. Traditionally, the idea has been to move investors from assets with strong growth potential but high volatility to assets that are more aligned with the nature of benefits to be taken as retirement approaches. Generally, this means moving members from investing in a high proportion of equities in their early years to a mixture of cash and long term bonds at retirement. In many cases, the transition from growth assets to this end date portfolio is achieved by switching linearly over a set time period (e.g. 10% a year over 10 years). This linear approach to lifestyle switching can be effective at reducing risk as retirement approaches but fails to adequately recognise the way that risk actually varies over time.

In recent years, some lifestyle plans have therefore adopted a more sophisticated approach, whereby they seek to identify the level of risk that an individual is able to tolerate over a given period of time, in order to establish a ‘Risk Budget’. Having identified a risk budget, a range of possible investment portfolios can then be examined to see which of them delivers the best returns within the budget for a given time period. The important thing to recognise here is that the longer the period of investment, the greater will be the ability to recover from short term losses and so the riskier that the investment strategy can be. But the key point is that this relationship is not linear. That is, because someone has twice as long to invest doesn’t mean they can take twice as much risk. So the straight line lifestyle strategies used by many traditional lifestyle products do not make the most effective use of the risk budget.

In fact, the relationship between time and risk gives a more convex move from growth assets to the end date portfolio of bonds and cash. This implies a need to stay in growth assets for longer but then switch out of them more aggressively than a straight-line lifestyle design would have us do. So the overall effect of this more sophisticated approach is that members can benefit somewhat more from the higher expected returns associated with growth assets while still benefiting from the de-risking approach that is critical to any lifestyle strategy.

In conclusion then, we have seen significant changes in DC investment designs over recent years with consideration of risk gaining more importance. The upcoming introduction of auto-enrolment will increase the focus on the design of default funds and we expect the industry will continue to innovate to deliver investment strategies that not only offer members better outcomes but hopefully a smoother journey along the way too.

|