|

|

The devil’s in the detail – Pensions deficit trackers need to be less ambiguous |

By Hugh Creasy, Actuary at Xafinity

Each month the Land Registry; the Department of Communities and Local Government; mortgage lenders, such as the Halifax and Nationwide; and property-related experts, such as the Royal Institute of Chartered Surveyors, tell us what has happened to property prices.

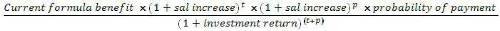

The casual observer could be forgiven for thinking something has gone wrong as the commentators tell apparently conflicting stories. If two say prices are up and one says prices are down, then one must have made a mistake? Wrong. All are correct in their own way, but each is looking at a different aspect of the residential property market. Some measure different stages of the housing cycle, some look at asking prices rather than prices paid, and some only apply to mortgaged properties or have a regional bias. All the approaches are, within reason, correct. What is often lacking is context, and without this it is all too easy to be misled. Just as a cash buyer is more interested in the Land Registry property results than, say, a first time buyer, so the finance director of a pension schemes is generally more concerned about corporate accounting policy than what may happen if every final salary scheme in the country went belly up. So, let’s help him separate what he needs to know from what can mislead him. Before we cast any more stones at our friendly housing economists, let’s just consider whether we are indeed without sin. Just how clear are the messages we broadcast as pensions actuaries? At the crux of the issue is that four financial measures are commonly used to quantify pension deficits: corporate accounting (“FRS17” or “IAS19”); scheme funding; solvency (aka “buy-out”); and PPF (e.g. “the PPF 7800”). One of my personal challenges for 2012 is to continue to produce our own pension deficit tracker, but also to improve understanding of where its conclusions sit within the world of defined benefit pension schemes. The first challenge is for all commentators to be clear about the purpose, assumptions and methodology of their calculations. The PPF 7800 and, I would hope, Xafinity’s make it clear. Can this be said for all? I do sometimes find myself having to look at the conclusions from a statement so as to back-solve what has been measured. Beware the headline “Corporate pension scheme deficits ...” It may be referring to a corporate pension scheme – true enough - but it is quoting a measure which is of interest to the trustees and has little consequence for the corporate. Moral of the story – “corporate” does not always mean “corporate perspective”. Before looking at the relevance of each type of measure, it is worth understanding how they differ. In common with those residential property indices, these differences are entirely justifiable, but subject of course to proper explanation. Three common differences are: choice of reference populations, which causes variation in the magnitude of deficits; reference periods (e.g. “an increase in deficits [during November]” may also be “a fall in deficits [over the year to November]”); detailed assumptions/model errors/slight differences in reference dates. Although these latter effects should have limited impact, picking the FTSE on 30/X-1 may present a very different picture from using FTSE on 1/X. I will come back to these, but let’s move on to the greater challenge. This is communicating the measure you are using to a lay audience. To illustrate the issues it’s worth dissecting the way in which we place a value on defined benefit pension liabilities. The starting point is to look at pension cashflows. These are calculated using current salary information and should be consistent across all measures. The pension instalment is then projected forward to the assumed date of retirement to allow for assumed future salary increases. Further increases are built in to take account of assumed pension increases after retirement, along with survival probabilities for the member. This is then totalled up over all potential payments and across all members of the scheme. Bringing this together, the reserve we set in today’s terms is equal to:

[t is term to retirement, p is term from retirement up to payment]

So, what are the differences across the measures that we see quoted, and what makes a specific measure more relevant to the reader?

Corporate accounting and scheme funding are very similar in their requirements. They use the same top line in the formula, i.e. a projection of the emerging defined benefit pension. There may be some variation as the funding estimate needs to be prudent, and so is expected to overstate, but this is a second order effect. The key difference is around the investment model. The scheme funding method is relatively unconstrained, e.g. if you have index-linked gilts or equity holdings, you can build them into your calculation. This means that the scheme funding assumed investment return varies widely from scheme to scheme and is a combination of a variety of asset classes. In complete contrast, and quite unlike scheme funding which works on how schemes may expect to invest, FRS17 and IAS19 directly link the assumed investment return to the yield on AA bonds. This applies to all schemes, regardless of the assets each scheme holds. This is the measure we look at in our monthly updates. FRS17 and IAS19 require the corporate to publish figures as at a given date. They are openly disclosed, without adjustment, and we find they are highly relevant to our corporate clients. It is easy to see why the PPF see the PPF 7800 index as a relevant measure for their purposes. Of course, the finance director may be less interested in the drain on PPF resources of all pension scheme sponsors going insolvent. Updates on “buy out” deficits will be good publicity for insurance companies and may catch the eye of both corporate sponsors and trustees. If those (dizzyingly high) deficits seem to be coming down, is now a time to ask for quotations? Perhaps it surprises me that a number of organisations produce regular updates of funding deficits, i.e. the measure trustees will monitor for long term contribution requirements. I said earlier that FRS17 and IAS19 disclosures require figures which are mechanistically produced and publicly disclosed from financial market data on a given date. Trustee advisers, particularly those old enough to remember the Minimum Funding Requirement, will know that funding advice must never be about mechanistic processes; the reality is that there is as much in judgement and interpretation as there is in mathematical calculation. For me, monitoring the funding deficit is like taking in the aroma of your cooking – it will give you a feel for how it is doing, but you really need to taste it if you want the full experience. I suppose the smell does tell you if it has burnt! So, does it really make a difference if you mistake funding deficits for FRS17/IAS19 deficits? As an example, the yield on AA corporate bonds could be 5% while the aggregate assumed return for scheme funding could be 5.5%. These may look similar, but over a (typical) term of 30 years, the difference in the bottom line of the formula makes FRS17 15% more expensive than scheme funding. That’s over £200 bn if you look at all company pension schemes. What really matters though is the way these measures change over time, i.e. what they are sensitive to. For FRS17 and IAS19 the answer is straightforward – the deficit changes as AA yields change. So, if AA bonds rise in value, the yield drops and the liability measure goes up. For scheme funding, you need to look at how those aggregate models are built up. In almost all cases the base reference point is the gilt yield, e.g. equities are set to be {gilt yield + 3%}. This means that scheme funding changes (if we are going to ignore the judgement call) are fed by changes in gilt yields. During Q3 of 2011 we saw AA yields stand still, while gilt yields fell dramatically. This means FRS17/IAS19 deficits stood still at the same time as scheme funding deficits rocketed. The position was even stranger as, at the same time, there was a second order effect through a fall in the outlook for inflation (top line in the formula). This meant we saw improvements in FRS17/IAS19 deficits at the same time as the considerable worsening in advertised scheme funding deficits. As to the other measures, solvency and PPF 7800, both depend on gilt yields and so move similarly to scheme funding. The PPF 7800 differs in that it does not look at scheme benefits. Instead, you need to rewrite the top line in the formula to represent PPF compensation rather than scheme pension. Either way, the deficit will tend to go up and down at the same time as scheme funding deficits, not corporate accounting. While the PPF is probably the most quoted, it is possibly the one that has the lowest relevance for most observers. This is because it represents worst case scenario planning as it looks at the possibility of all schemes defaulting. Never say never, but that seems unlikely. Coming back to those final three points of differentiation, they were different reference populations, different reference periods and different assumptions/model errors. Again, PPF 7800 and Xafinity are clear as both use almost the entire universe of PPF eligible schemes. Some indices select just the FTSE 100 or FTSE 350. While the direction of movement should be the same whichever you use, the magnitude will clearly be very different and there is real potential for a casual observer to dismiss the severity of pensions deficits. For example, Xafinity may quote deficits of £400 bn, whereas another index is published a few days later using a much smaller, but seemingly significant, universe such as the FTSE 100, and quotes just £35 bn. Reference points will always be a moot area, but as long as they are clearly stated, these just lead to differing perspectives. For example, “deficits plummet” may be true over the single month for one organisation’s update, while another looks at the year on year change, which happens to be “deficits soar”. One of the joys of statistics, I suppose. Finally, different assumptions/model errors will creep in and inevitably muddy the waters a little. The greater effect is when one organisation has measured just before an equity market fall or a drop in yields. Once again, as long as the assumptions are totally transparent, it does not cause a problem, but it does need explaining. My final point picks up on transparency and my hope is that this does not just translate into detailing the methodology used in the trackers. Like any decent consultant, what we should be doing is putting our news into context for the reader so that they understand how to interpret the results. At the end of the day, few will have the pleasure of such in-depth knowledge as the readers of this article. |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.