|

|

Football fans around the world will have heard the phrase "Barcelona DNA" which was rumoured to have been said by Pep Guardiola (though I couldn't find any actual evidence of it). It's one of those idioms that requires little explanation and, following a conversation with a colleague a while back, I wondered what it is that makes "Chief Actuary DNA" |

By Michael Stefan, Partner at Hanover Search Group

(and yes, I do often mix football and actuarial in one conversation!)

It's a question I have been asked a number of times by aspiring chief actuaries but answering it is very difficult for a number of reasons. First of all, you have to define "Chief Actuary" and a cursory look at Linkedin will reveal a number of companies with multiple "Chief Actuaries". I suspect "grade inflation" has something to do with it and of course it need not indicate any embellishment - plenty of large (re) insurers have multiple business units, each with its own "Chief Actuary". I decided to do a bit of research and was struck by how difficult it was to come up with even a consistent sample so I decided to focus my efforts on a very strict definition of "Chief Actuary" - namely holders of the Institute & Faculty of Actuaries (IFoA) "Chief Actuary, Non Life with Lloyds" certificate. As of today (25th of August), 97 such certificates have been issued, the vast majority to UK domiciled actuaries.

It is a certificate that has been recently introduced by the IFoA as one of a number of practicing certificates (http://goo.gl/shrSE5). I realise the area in question is rather niche when compared to the global actuarial profession but I hope to shine a light over a very specific area of the market and in due course may extend the analysis to other fields. In doing so, I wanted to find some hard data to support a number of questions:

just how academic do you need to be?

• do you need to have worked for a regulator? • how much experience do you need?

Before I delve into my findings, some notes on methodology: a list of all actuaries holding the certificate was downloaded from the public section of the IFoA website and entered into an Excel spreadsheet that was then run through Tableau Public v10 to help with visualisation. I would assume the list is updated by the IFoA on a regular basis so it will grow (or shrink) over time.

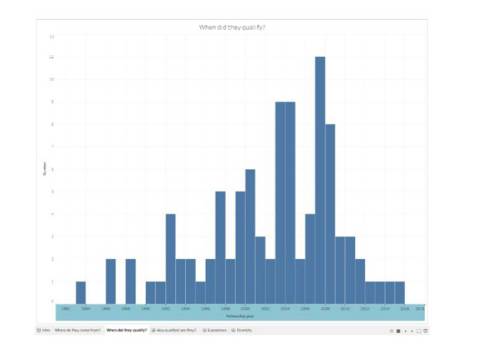

The first question one generally asks is: "how much experience do you need?" In any study, one hopes for as much information as possible but looking at a population of professionals makes this a very difficult task. We know and network with a number of senior actuaries but it's simply impossible to know when everyone started out. What we do know for a fact is the year each of those actuaries qualified, and this can be used as a proxy for the number of years experience.

The IFoA states that "average qualification time is 3 to 6 years" (http://goo.gl/LTnXcU) and to me, 5 years sounds about right. Looking at the distribution above, one can see that nearly half qualified between 2000 and 2008, so that would imply the "typical" Chief Actuary at Lloyds has between 13 and 21 years experience. It's worth noting that this experience need not be solely within GI, and indeed, there is a generation of pre 2000 Fellows who often started out their careers in life and pensions.

It's also worth considering whether the often-heard myth about actuaries having lofty academics is true. Only 22 out of 97 hold a master's level qualification (so less than a quarter) and only 3 have a PhD so perhaps the myth never held true in the first place.

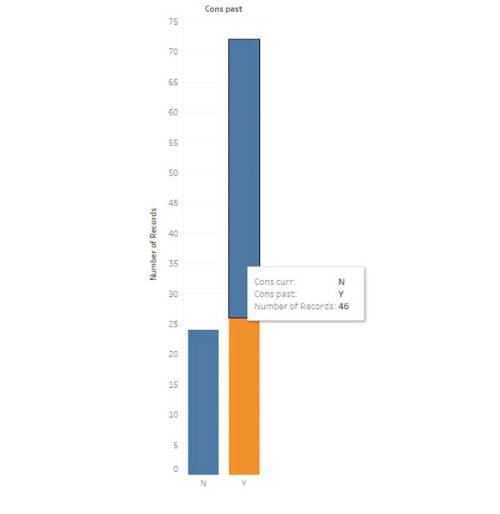

A natural question to ask at this point is "surely most people who hold the Lloyds SAO certificate work for the consultancies?" and again, the answer surprised me somewhat. Only 26 are currently working as a consultant (ranging from truly independent consultant, to owning a small consultancy, to working as a consulting actuary for a large consultancy or audit firm). Even more surprisingly, 72 (nearly three quarters) have worked for a consulting firm at some point in their career (and this number includes the ones currently in a consulting work). Whilst the consultancies are never short of applicants for their graduate intakes, experienced level hiring within the consulting space is often far more difficult, especially at the more senior levels. My personal view is that many experienced Fellows tend to steer clear of consulting as they see the job as being more about sales than anything else (which is not always the case), as well as the fact they almost always seem to know someone who has tried consulting at a later stage and hated it (bad experiences always spread more than good ones).

So it would seem that consulting experience is more valuable to employers than previously thought? Well let's look at the data further; of the 72 who are not currently consultants (and are therefore true "Chief Actuaries"), 46 (over half) have previously worked as a consultant.

Intuition would also say that having previously worked for Lloyds (or holding a certificate to sign Lloyds statements of actuarial opinion) would help but the evidence is not that strong. Only 13% have previously worked for Lloyds of London and only 27 of the 96 also hold a certificate to sign Lloyds SAOs (and 17 of those work in consulting).

That last finding would indicate that the majority of syndicates still commission the SAO signing process to an outside consultancy; indeed, looking at the sample data, 60 of the 72 chief actuaries who work in house do not hold a Lloyds SAO certificate, which would indicate the process is either done by another member of their team (as is the case in some of the largest groups) or is indeed outsourced to a consultant.

What about diversity? Diversity has been a hot topic (and rightly so) for a number of years although progress seems to be achingly slow. The Lloyds market has always had a bit of a "mystique" about it and it would be easy to assume that in order to break through as a Chief Actuary you need to look and speak the part, wear the "right" tie and so on. Luckily, the "club" may not be as elusive as one thinks. I analysed the data (scarce as it was) along 3 dimensions:

• male/female representation • English as a first language • attendance of Oxford & Cambridge On all 3 counts, the "Chief Actuary" club is actually pretty diverse; female representation is still too low (13%), and English is overwhelmingly the first language (85 were born in the UK, Ireland, South Africa, Australia and New Zealand).

Most encouraging though is the fact that Oxbridge attendance is not needed at all - only 15% attended Oxford or Cambridge (at either undergraduate or post graduate level).

So, what advice would I give to an aspiring chief actuary? First and foremost, be patient. Longevity (excuse the pun!) counts for a great deal. Many of the current crop of "Chief Actuaries" qualified in the 1990-2000 period and will be in their late 40s/early 50s. It is normal that they will start vacating roles over the next decade, leaving space for the younger generation. That being said, if you're under 30 (and even 35) it's very unlikely you'll be a chief actuary soon (though I am sure there will always be exceptions!).

Second, consulting experience is probably more valuable than you think. If you've never done, and you are qualified, you should probably give it a go. Being frank, experienced level consulting searches are always more difficult to fill than should be the case and that's largely due to the reluctance of many people to even consider it.

Thirdly, it's not as exclusive a club as you might think; I am sure female participation rates will be higher in 5 years time, and you don't need to have attended Oxbridge or be a rocket scientist to "get in".

What is absolutely essential is that you qualify, develop business acumen and critically, good communication skills (not just presenting but also listening). A touch of luck is also useful (but this is far more difficult to analyse objectively!).

I hope people find it a useful read and I would be happy to discuss my findings with any interested party. I am fortunate enough to work with a group of people who share extensive experience of recruiting at the "Chief Actuary" level. I hope my analysis stands up to scrutiny but I'm happy to take on board any comments, especially of a statistical nature.

Working with such a small sample set (97) is inherently very difficult but I hope it's a start and perhaps in 5 years time the "club" will be much larger!

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.