Gradually easing into retirement by working 1, 2 or 3 days per week for a few years after the age of 66 can boost a pension pot by tens of thousands of pounds, new analysis from Standard Life, part of Phoenix Group, reveals, as research highlights how future generations’ view of retirement is shifting.

Less than one in five (17%) current retirees moved to part time work once they reached retirement age, with the majority (76%) stopping work entirely, according to Standard Life’s Retirement Voice report. Younger generations, however, plan to wind down their working hours, with almost half (47%) of 18- to 24-year-olds anticipating moving into part-time work, while 29% expect to stop work completely.

Pension pot can profit from winding down working hours

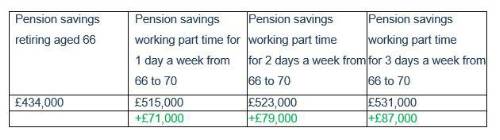

With younger generations intending to carry on working part time after reaching retirement age, Standard Life has conducted analysis which highlights how a gradual wind down of work can add a significant amount to the overall value of a pension pot. For example, someone that began working on a salary of £25,000 per year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could have a total retirement fund of £434,000 by the age of 66. However, someone that worked 3 days a week from the age of 66 to 70 could add £87,000 to their pension pot. Working just 1 day a week for a few years after reaching retirement age could add as much as £71,000 to a retirement fund. These figures are not adjusted for inflation.

Impact of working past retirement age

*if beginning working with a salary of £25,000 per year and paying 5% monthly employee contributions and 3% employer contributions into a workplace pension at the age of 22 and assuming 3.5% salary growth and 5% investment growth per year. Figures are not reduced to take effect of inflation. Annual Management Charge of 1.00% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Dean Butler, Managing Director for Retail Direct at Standard Life said: “People’s approach to retirement is shifting, with many preferring to gradually ease into retirement by reducing working hours rather than suddenly stopping work altogether. Younger generations perhaps realise that the onus will be on them, rather than their employer, to ensure they have enough to live in throughout later life and retirement. As pension policy has evolved, individuals now have much more responsibility for funding their own retirement which may mean working for longer, whereas older generations have largely benefited from Defined Benefit (DB) pensions which have provided financial security and allowed many to immediately move into full retirement.

“For future generations who will be retiring into a very different pension landscape than their predecessors, reducing working hours or taking on part time work can not only boost pension savings, but it’s also a healthy way to phase into retirement and start to understand what the day-to-day reality of life without work looks like. Of course, this only works if you’re not accessing your pension while reducing your working days – if you can live on your income from work or have other savings.”

Catherine Sermon, Head of Public Engagement and Campaigns at Phoenix Insights, Phoenix Group’s longevity think tank, comments: “Part-time work can be a game changer for those who want or need to remain in work after state pension age, offering the flexibility for people to continue to earn and work while managing other life or health needs. Financially, there are huge benefits from maintaining an income from work as it means people may be able to reduce how much they take from their retirement savings each month or delay taking any out at all. For some, it may even mean they can continue to save and boost their retirement pot.

“The ‘hard stop’ retirement has been superseded by those opting for a gradual transition and it’s likely we’ll see a rise in people who will never fully retire. Part-time work plays a vital role in this changing approach, but we need to ensure we address the barriers people face accessing reduced hours working, especially later in life.”

|