By Barney Wanstall, Director, Insurance, PwC

The need for change in how validation currently works is clear: many firms are spending large amounts of money and deploying significant amounts of resource into their validation process. As confidence in models develops and they begin to get approved the appetite for continued investment in validation will, (and already has for some firms) diminished significantly. At the same time there is a desire to maintain confidence in the model and recognition that validation plays an essential part in providing this assurance and confidence.

As part of our work we sent out an industry questionnaire to find out the opinion of the industry on the maturity of different aspects of their validation process. There were a number of interesting results – it was immediately evident that few firms had a clear process to determine how validation scope should be set, and to clearly indicate when additional validation was needed (ie a “trigger”). For instance, when asked the question “does your firm have a formal mechanism for assessing potential triggers for validation” 64% of firms reported that they still had much progress to make in this area. It was also clear from the survey that this was because most validation to date has been focused on the whole model, rectifying previous issues and the overall ScR result.

It was clear from the survey that there had been precious little validation of other model uses for instance. This is unsustainable in the long term and helped us realise that helping firms get the scope right for future validation is vital.

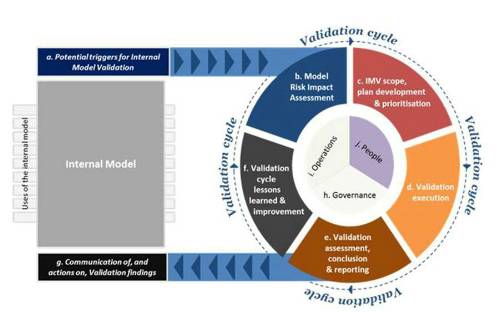

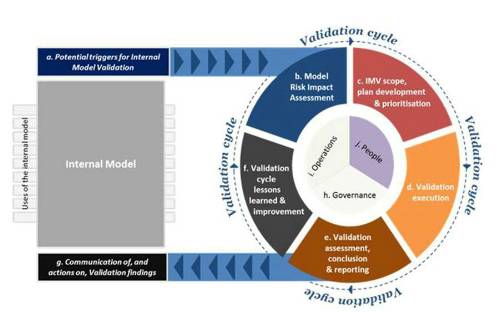

It is clear that validation needs to change and develop. It needs to move away from a formulaic and cyclic process towards one which is far more dynamic and efficient -recognising what is changing across the model, the risk profile, the industry and the wider environment. For established models, we believe that most validation will be focussed primarily on responding to issues and developments which could potentially render it less effective. It is for this reason we developed a cycle – to illustrate how validation should work in the longer term and to demonstrate that validation is something which needs to continually evolve.

The cycle was developed through discussions with a number of life and non-life insurers and the PRA. The main focus has been to help firms by articulating the validation cycle in a useful way, identifying the key elements of the cycle and providing a pragmatic and common platform on which validation should be based. The following diagram articulates these components:

The guide works through the segments of the cycle and provides a number of best practice principles on each area to help firms assess and implement a validation cycle which is robust, sustainable and efficient.

|