Whilst money can never replace someone, it can be a huge help for the family left behind.

To find out if your postcode can impact your premium, the UK’s biggest life insurance broker Reassured has analysed 5 years of internal data, made up of over 130,000 life insurance policies.

The data reveals that the average life insurance premium in the UK costs just under £25 a month (£24.95). This works out as approximately half of the average monthly mobile phone bill. Considering the difference it could make to your loved ones, life insurance doesn’t really seem that expensive.

Similar to car and home insurance, life insurance underwriting is based on a number of complex calculations, meaning people can pay different premiums depending on their age, location, and level of cover, amongst other factors.

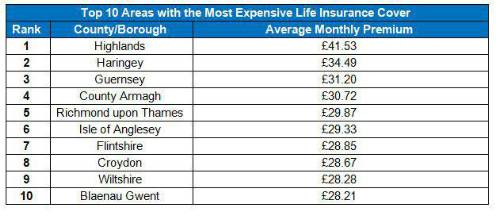

Premiums are calculated based on the likelihood of a claim being made. The short life expectancy and high levels of drug-related deaths could explain why residents in the Highlands pay the costliest premium in the UK, with an average monthly charge of £41.53:

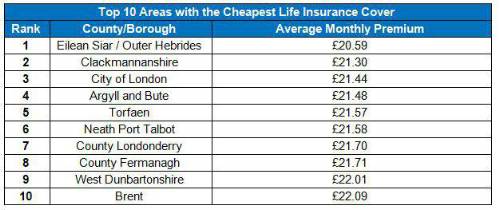

However, the nearby islands of the Outer Hebrides are reported to have the lowest average monthly premiums, coming to just £20.59:

Regardless of where in the UK you live, the cost of cover can vary significantly between providers. Therefore, it is always best to compare multiple quotes to ensure you receive the best deal.

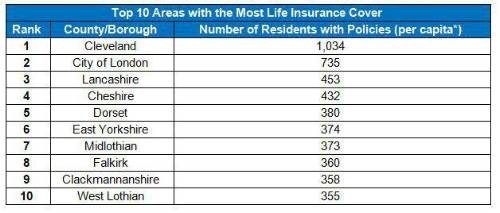

Reassured’s study found that Cleveland, in the North East of England, topped the charts as the area with the highest proportion of life insurance policies. The data shows that 1,034 residents per 100,000 have taken out cover:

The City of London placed 2nd, with 735 life insurance policies per 100,000 residents, and Lancashire came 3rd (453 per 100,000). Cheshire and Dorset complete the top five areas with the highest proportion of residents buying life insurance cover, based off the data available.

Interestingly, Scottish counties make up almost half of the top 10. This could be because a large number of insurance companies are headquartered north of the English border. In fact, nearly a quarter of the UK’s life insurance employees are based in Edinburgh.

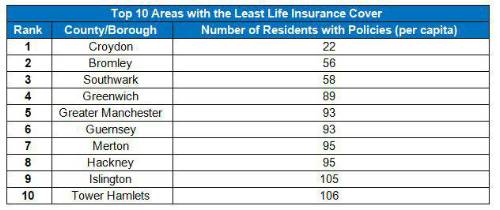

Looking at the areas with the least life insurance coverage, Reassured data shows that the South London Borough of Croydon is home to only 22 people per 100,000 residents that have taken out a life insurance policy:

The London boroughs of Bromley and Southwark placed 2nd and 3rd for the lowest number of residents with life insurance policies, taking out only 56 and 58 policies per 100,000 residents respectively. The data available shows that Greenwich and Greater Manchester complete the top 5 areas with the lowest life insurance coverage.

London boroughs account for all but two of the top 10 areas with the least life insurance coverage. The capital regularly ranks as the most expensive place to live in the UK. Perhaps it is therefore unsurprising that London residents don’t want the perceived additional expense of life insurance premiums, despite the area ranking 3rd for cheapest monthly premium (£21.44).

View the full set of findings on the Reassured website here.

For FAQs about life insurance and coronavirus, please see the dedicated help page here.

Commenting on the findings, Phil Jeynes, Head of Corporate Sales at Reassured said: “It really is eye-opening to see the differences between UK areas when it comes to life insurance coverage and average premiums. But with the UK average premium falling just short of £25 per month, it highlights life insurance could be more affordable than people think.

“To protect yourself and your loved ones, life insurance can offer financial assistance, helping to take some of the stress out of planning for the future. Each insurer uses a different underwriting process, so shop around to get the best deal for you.”

|