Workers who stop contributions could miss out on employer matching, where employers match pension contributions if the employee pays in more, with some generous companies offering double matching

Stopping pension savings may bump up take home pay by £1,404 per annum, but means losing out on £4,092 pension savings a year for workers earning £35k

One in ten (12%) pension savers are reducing the amount they pay into workplace savings

Cost of living (55%) and, specifically, rising mortgage costs (15%) are two of the main reasons

Decisions taken to boost take home pay in the short term can have a dramatic impact on people’s future wealth, according to analysis by Royal London.

Reducing or stopping pension contributions may seem an effective solution to current cash flow woes. However, a short term boost to take home pay impacts the long term pension value, especially for higher earners, who miss out by almost four times as much.

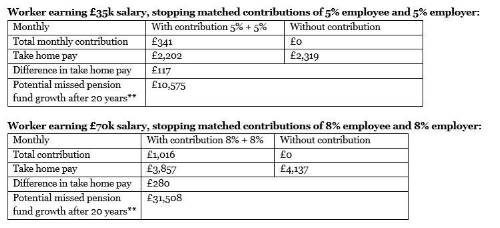

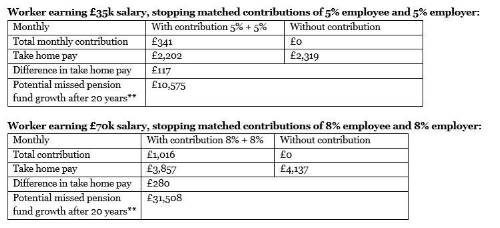

Pension contributions attract tax relief on the money that goes into their pension. If you take the example of a worker earning £35,000 a year and in a workplace pension scheme saving 5% matched by their employer, they could increase their take home pay by £117 per month, or £1,404 a year, if they stopped paying into their pension. However, crucially in doing so they would miss out on £341 per month or £4,092 per year in pension savings, as a result of lost matched contributions and tax relief.

Pension wealth benefits hugely from compounding, or to put it another way, the magic of time. The longer money is invested, the more it could grow. In 20 years’ time the £4,092 could have boosted the pension pot by £10,575 through investment growth had the contributions not been paused.

For a higher rate taxpayer on a salary of £70,000, the difference is starker. While they could bump up their take home pay by £3,360 a year by stopping 8% matched pension contributions, their pension pot would be worse off by £12,192 in the period. Their pension savings would also be worse off by a projected £31,508 in 20 years’ time had they not taken a one-year pause.

New research from Royal London, carried out with over 6,000 UK adults, clearly shows that the past two years have taken their toll on people’s finances, with a third (33%) of workers of all ages admitting they have looked into decreasing or stopping their pension contributions. Among younger workers, the figures are even more startling with half (49%) of workers aged between 18-34 looking at the impact of adjusting their pension contributions.

The benefits lost by opting out of a workplace pension

A decision to exit your savings scheme means missing out on the benefits of saving through a workplace pension. To begin with you’ll miss out on your employer’s contribution. Any breaks in savings could also delay your retirement or mean you’ll have less income when you stop working, and catching up on any breaks will mean saving even more when you resume to achieve your desired lifestyle in retirement.

While the number of people opting out of schemes remains relatively low, it’s clear that a lot of people have considered the option in a bid to boost their take home pay.

Assumptions: Employee contribution matched by employer, using salary exchange, all national insurance savings re-directed to member’s pension

Justin Corliss, senior pensions development manager at Royal London, commented: “It will come as a surprise to many just how much you stand to lose by opting out of your workplace pension for one year.

“With the cost of living, driven in particular by mortgage payments and rent, ramping up, workers across the earnings spectrum are having to juggle their finances. However, the decision to pause pension contributions is one that needs to be weighed up carefully, especially for those at the start of their career. Stopping or reducing contributions might be necessary for some, but it’s vital that decisions aren’t taken on a whim. The figures show that the money gained in the short term doesn’t appear great value when compared to what’s being given up in the longer term.”

|